Xerox 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

Goodwill and Other Intangible Assets: Effective

January 1, 2002, we adopted Statement of Financial

Accounting Standards No. 142, “Goodwill and Other

Intangible Assets” (“SFAS No. 142”), whereby good-

will was no longer to be amortized, but instead is to be

tested for impairment annually or more frequently if

an event or circumstance indicates that an impairment

loss may have been incurred. In 2002, we recorded an

impairment charge of $63 as a cumulative effect of

change in accounting principle in the accompanying

Consolidated Statements of Income. Upon adoption of

SFAS No. 142, we reclassified $61 of intangible assets

to goodwill. Prior to adoption, goodwill and identifiable

intangible assets were amortized on a straight-line

basis over periods ranging from 5 to 40 years. Pro

forma net loss as adjusted for the exclusion of amorti-

zation expense of $59 for the year ended December

31, 2001 was $35 or $0.06 per share.

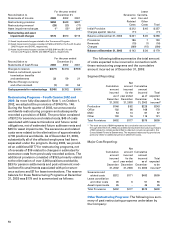

The following table presents the changes in the

carrying amount of goodwill, by operating segment,

for the years ended December 31, 2003 and 2002:

Production Office DMO Other Total

Balance at

January 1, 2002 $605 $710 $ 70 $121 $1,506

Foreign currency

translation

adjustment 82 55 (3) – 134

Impairment charge – – (63) – (63)

Divestitures (4) – (1) – (5)

Other – (5) (3) – (8)

Balance at

December 31, 2002 $683 $760 $ – $121 $1,564

Foreign currency

translation

adjustment 88 67 – 3 158

Balance at

December 31, 2003 $771 $827 $ – $124 $1,722

All intangible assets relate to the Office operating

segment and were comprised of the following as

of December 31, 2003:

Accu-

Amorti- Gross mulated

zation Carrying Amorti- Net

Period Amount zation Amount

Installed customer base 17.5 years $209 $ 45 $164

Distribution network 25 years 123 20 103

Existing technology 7 years 103 56 47

Trademarks 7 years 23 12 11

$458 $133 $325

Amortization expense related to intangible assets

was $35, $36, and $40 for the years ended December

31, 2003, 2002 and 2001, respectively, and is expected

to approximate $36 annually through 2008.

Revenue Recognition: In the normal course of busi-

ness, we generate revenue through the sale and rental

of equipment, service and supplies and income asso-

ciated with the financing of our equipment sales.

Revenue is recognized when earned. More specifically,

revenue related to sales of our products and services

is recognized as follows:

Equipment: Revenues from the sale of equipment,

including those from sales-type leases, are recognized

at the time of sale or at the inception of the lease, as

appropriate. For equipment sales that require us to

install the product at the customer location, revenue is

recognized when the equipment has been delivered to

and installed at the customer location. Sales of cus-

tomer installable products are recognized upon ship-

ment or receipt by the customer according to the

customer’s shipping terms. Revenues from equipment

under other leases and similar arrangements are

accounted for by the operating lease method and are

recognized as earned over the lease term, which is

generally on a straight-line basis.

Service: Service revenues are derived primarily from

maintenance contracts on our equipment sold to cus-

tomers and are recognized over the term of the con-

tracts. A substantial portion of our products are sold

with full service maintenance agreements for which

the customer typically pays a base service fee plus a

variable amount based on usage. As a consequence,

other than the product warranty obligations associat-

ed with certain of our low end products in the Office

segment, we do not have any significant product

warranty obligations, including any obligations under

customer satisfaction programs.

Supplies: Supplies revenue generally is recognized

upon shipment or utilization by customer in accor-

dance with sales terms.

Revenue Recognition Under Bundled Arrangements:

We sell most of our products and services under bun-

dled contract arrangements, which contain multiple

deliverable elements. These contractual lease arrange-

ments typically include equipment, service, supplies

and financing components for which the customer

pays a single negotiated price for all elements. These

arrangements typically also include a variable compo-

nent for page volumes in excess of contractual mini-

mums, which are often expressed in terms of price per

page, which we refer to as the “cost per copy.” In a

typical bundled arrangement, our customer is quoted

a fixed minimum monthly payment for 1) the equip-

ment, 2) the associated services and other executory

costs, 3) the financing element and 4) frequently sup-

plies. The fixed minimum monthly payments are mul-

tiplied by the number of months in the contract term

to arrive at the total fixed minimum payments that the