Xerox 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Note 1 – Summary of Significant

Accounting Policies

References herein to “we,” “us” or “our” refer to

Xerox Corporation and its subsidiaries unless the con-

text specifically requires otherwise.

Description of Business and Basis of Presentation: We

are a technology and services enterprise, as well as a

leader in the global document market, developing,

manufacturing, marketing, servicing and financing a

complete range of document equipment, software,

solutions and services.

Liquidity, Financial Flexibility and Funding Plans: We

manage our worldwide liquidity using internal cash

management practices which are subject to (1) the

statutes, regulations and practices of each of the local

jurisdictions in which we operate, (2) the legal require-

ments of the agreements to which we are parties and

(3) the policies and cooperation of the financial institu-

tions we utilize to maintain and provide cash manage-

ment services.

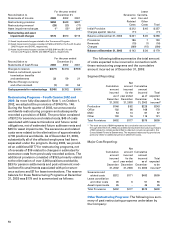

In June 2003, we completed a $3.6 billion recapi-

talization (the “Recapitalization”) that included the

offering and sale of 9.2 million shares of 6.25 percent

Series C Mandatory Convertible Preferred Stock,

46 million shares of Common Stock, $700 of 7.125 per-

cent Senior Notes due 2010 and $550 of 7.625 percent

Senior Notes due 2013 and the closing of our new

$1.0 billion credit agreement which matures on

September 30, 2008 (the “2003 Credit Facility”). The

2003 Credit Facility consists of a fully drawn $300 term

loan and a $700 revolving credit facility (which includes

a $200 sub-facility for letters of credit). The proceeds

from the Recapitalization were used to repay the

amounts outstanding under the Amended and

Restated Credit Agreement we entered into in June

2002 (the “2002 Credit Facility”). Upon repayment of

amounts outstanding, the 2002 Credit Facility was ter-

minated and we incurred a $73 charge associated with

unamortized debt issuance costs.

On December 31, 2003, we had $700 of borrowing

capacity under the 2003 Credit Facility, less $51 utilized

for letters of credit. The 2003 Credit Facility contains

affirmative and negative covenants, financial mainte-

nance covenants and other limitations. The indentures

governing our outstanding senior notes contain sever-

al affirmative and negative covenants. The senior

notes do not, however, contain any financial mainte-

nance covenants. The covenants and other limitations

contained in the 2003 Credit Facility and the senior

notes are more fully discussed in Note 10. Our U.S.

Loan Agreement with General Electric Capital

Corporation (“GECC”) (effective through 2010) relating

to our vendor financing program (the “Loan

Agreement”) provides for a series of monthly secured

loans up to $5 billion outstanding at any time. As of

December 31, 2003, $2.6 billion was outstanding

under the Loan Agreement. The Loan Agreement, as

well as similar loan agreements with GE in the U.K.

and Canada that are discussed further in Note 4, incor-

porates the financial maintenance covenants con-

tained in the 2003 Credit Facility and contains other

affirmative and negative covenants.

At December 31, 2003, we were in full compliance

with the covenants and other provisions of the

2003 Credit Facility, the senior notes and the Loan

Agreement and we expect to remain in full compli-

ance for at least the next twelve months. Any failure

to be in compliance with any material provision or

covenant of the 2003 Credit Facility or the senior notes

could have a material adverse effect on our liquidity

and operations. Failure to be in compliance with the

covenants in the Loan Agreement, including the finan-

cial maintenance covenants incorporated from the

2003 Credit Facility, would result in an event of termi-

nation under the Loan Agreement and in such case

GECC would not be required to make further loans to

us. If GECC were to make no further loans to us and

assuming a similar facility was not established, it

would materially adversely affect our liquidity and our

ability to fund our customers’ purchases of our equip-

ment and this could materially adversely affect our

results of operations.

With $2.5 billion of cash and cash equivalents on

hand at December 31, 2003 and borrowing capacity

under our 2003 Credit Facility of $700, less $51 utilized

for letters of credit, we believe our liquidity (including

operating and other cash flows that we expect to gen-

erate) will be sufficient to meet operating cash flow

requirements as they occur and to satisfy all sched-

uled debt maturities for at least the next twelve

months. Our ability to maintain positive liquidity going

forward depends on our ability to continue to generate

cash from operations and access the financial mar-

kets, both of which are subject to general economic,

financial, competitive, legislative, regulatory and other

market factors that are beyond our control.

Our ability to obtain financing and the related cost

of borrowing is affected by our debt ratings, which are

periodically reviewed by the major credit rating agen-

cies. Our current credit ratings are below investment

Notes to the Consolidated Financial Statements

(Dollars in millions, except per-share data and unless otherwise indicated)