Xerox 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

In December 2003, STHQ Realty LLC was formed

to finance the acquisition of the Company’s headquar-

ters in Stamford, Connecticut. While the assets and lia-

bilities of this special purpose entity are included in

the Company’s Consolidated Financial Statements,

STHQ Realty LLC is a bankruptcy-remote separate

legal entity. As a result, its assets of $44 at December

31, 2003, are not available to satisfy the debts and

other obligations of the Company.

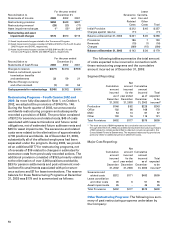

Note 7 – Investments in Affiliates,

at Equity

Investments in corporate joint ventures and other

companies in which we generally have a 20 to 50 per-

cent ownership interest at December 31, 2003 and

2002 were as follows:

2003 2002

Fuji Xerox (1) $556 $563

Investment in subsidiary trusts

issuing preferred securities 69 66

Other investments 19 66

Investments in affiliates, at equity $644 $695

(1) Fuji Xerox is headquartered in Tokyo and operates in Japan and other

areas of the Pacific Rim, Australia and New Zealand. We previously sold

half our interest in Fuji Xerox to Fuji Photo Film Co., Ltd. in March 2001.

Our investment in Fuji Xerox of $556 at December 31, 2003, differs from

our implied 25 percent interest in the underlying net assets, or $623, due

primarily to our deferral of gains resulting from sales of assets by us to

Fuji Xerox, partially offset by goodwill related to the Fuji Xerox investment

established at the time we acquired our remaining 20 percent of Xerox

Limited from The Rank Group (plc). Such gains would only be realizable if

Fuji Xerox sold a portion of the assets we previously sold to it or if we

were to sell a portion of our ownership interest in Fuji Xerox.

Our equity in net income of our unconsolidated

affiliates for the three years ended December 31, 2003

was as follows:

2003 2002 2001

Fuji Xerox $41 $37 $47

Other investments 17 17 6

Total $58 $54 $53

Equity in net income of Fuji Xerox is affected by

certain adjustments to reflect the deferral of profit

associated with intercompany sales. These adjustments

may result in recorded equity income that is different

than that implied by our 25 percent ownership interest.

Condensed financial data of Fuji Xerox as of and

for the three calendar years ended December 31, 2003

follow:

2003 2002 2001

Summary of Operations

Revenues $8,430 $7,539 $7,684

Costs and expenses 8,011 7,181 7,316

Income before income taxes 419 358 368

Income taxes 194 134 167

Minorities’ interests 34 36 35

Net income $ 191 $ 188 $ 166

Balance Sheet Data

Assets :

Current assets $3,273 $2,976 $2,783

Long-term assets 4,766 3,862 3,455

Total assets $8,039 $6,838 $6,238

Liabilities and

Shareholders’ Equity:

Current liabilities $2,594 $2,152 $2,242

Long-term debt 443 868 796

Other long-term liabilities 2,391 1,084 632

Minorities’ interests in equity

of subsidiaries 118 227 201

Shareholders’ equity 2,493 2,507 2,367

Total liabilities and

shareholders’ equity $8,039 $6,838 $6,238

We have a technology agreement with Fuji Xerox

whereby we receive royalty payments and rights to

access their patent portfolio in exchange for access

to our patent portfolio. In 2003, 2002 and 2001, we

earned royalty revenues under this agreement of

$110, $99 and $101, respectively. We also have

arrangements with Fuji Xerox whereby we purchase

inventory from and sell inventory to Fuji Xerox.

Pricing of the transactions under these arrangements

is based upon negotiations conducted at arm’s length.

Certain of these inventory purchases and sales are the

result of mutual research and development arrange-

ments. Our purchase commitments with Fuji Xerox

are in the normal course of business and typically

have a lead time of three months. Purchases from

and sales to Fuji Xerox for the three years ended

December 31, 2003 were as follows:

2003 2002 2001

Sales $129 $113 $132

Purchases $871 $727 $598

In addition to the payments described above,

in 2003 and 2002, we paid Fuji Xerox $33 and $20,

respectively, and in 2003 and 2002 Fuji Xerox paid us

$9 and $10, respectively, for unique research and

development.

Note 8 – Segment Reporting

Our reportable segments are consistent with how we

manage the business and view the markets we serve.

Our reportable segments are Production, Office,

Developing Markets Operations (“DMO”) and Other.

The accounting policies of all of our segments are the