Xerox 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

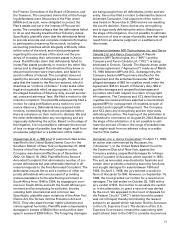

Assumptions

Pension Benefits Other Benefits

2003 2002 2001 2003 2002 2001

Weighted-average assumptions used to

determine benefit obligations at the

plan measurement dates

Discount rate 5.8% 6.2% 6.8% 6.0% 6.5% 7.2%

Rate of compensation increase 3.9 3.9 3.8 N/A N/A N/A

Pension Benefits Other Benefits

2004 2003 2002 2001 2004 2003 2002 2001

Weighted-average assumptions used to

determine net periodic benefit cost for

years ended December 31

Discount rate 5.8% 6.2% 6.8% 7.0% 6.0% 6.5% 7.2% 7.5%

Expected return on plan assets 8.1 8.3 8.8 8.9 N/A N/A N/A N/A

Rate of compensation increase 3.9 3.9 3.8 3.8 N/A N/A N/A N/A

2003 2002

Assumed health care cost

trend rates at December 31

Health care cost trend rate

assumed for next year 11.4% 13.8%

Rate to which the cost trend rate

is assumed to decline

(the ultimate trend rate) 5.2% 5.2%

Year that the rate reaches the

ultimate trend rate 2008 2008

Assumed health care cost trend rates have a

significant effect on the amounts reported for the

health care plans. A one-percentage-point change in

assumed health care cost trend rates would have the

following effects:

One-percentage- One-percentage-

point increase point decrease

Effect on total service and

interest cost components $ 4 $ (4)

Effect on post-retirement

benefit obligation $60 $(56)

Medicare Prescription Drug, Improvement and

Modernization Act of 2003

In December 2003, the Medicare Prescription Drug,

Improvement and Modernization Act of 2003 (“Act”)

was signed into law. The Act will provide prescription

drug coverage to retirees beginning in 2006 and will

provide subsidies to sponsors of post-retirement

medical plans that provide prescription drug cover-

age. The obligations and benefit costs related to our

post-retirement medical plan disclosed above, do not

include the expected favorable impact of the Act,

pending authoritative accounting guidance regarding

how the benefit is to be recognized in the financial

statements in accordance with the provisions of FASB

Staff Position 106-1, “Accounting and Disclosure

Requirements Related to the Medicare Prescription

Drug, Improvement and Modernization Act of 2003,”

which was issued in January 2004. As the final guid-

ance has yet to be issued, we are unable to estimate

the impacts to our post-retirement benefit plan liabili-

ties. The issuance of final guidance could cause us to

change the other post-retirement benefits financial

information being reported above.

Employee Stock Ownership Plan (“ESOP”) Benefits: In

1989, we established an ESOP and sold to it 10 million

shares of our Series B Convertible Preferred Stock (the

“Convertible Preferred”) for a purchase price of $785.

Each Convertible Preferred share is convertible into 6

shares of our common stock. The Convertible Preferred

has a $1 par value and a guaranteed minimum value of

$78.25 per share and accrues annual dividends of $6.25

per share, which are cumulative if earned. The divi-

dends are payable in cash or additional Convertible

Preferred shares, or in a combination thereof.

When the ESOP was established, the ESOP bor-

rowed the purchase price from a group of lenders. The

ESOP debt was included in our Consolidated Balance

Sheet as debt because we guaranteed the ESOP bor-

rowings. A corresponding amount was classified as

Deferred ESOP Benefits, offsetting a portion of the

Convertible Preferred shares included in Shareholders’

Equity in our Consolidated Balance Sheets, and repre-

sented our commitment to future compensation

expense related to the ESOP benefits. In the second

quarter of 2002, we purchased the outstanding balance

of ESOP debt of $135 from third-party holders. In con-

nection with this purchase, we recorded an intercom-

pany receivable from the ESOP trust and the ESOP

recorded an intercompany payable to us, which elimi-

nated in consolidation. Accordingly, the purchase of

the ESOP debt effectively represented a retirement of

third party debt and therefore such debt was no longer

included in our Consolidated Balance Sheets. The pur-