Xerox 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

as equipment sales increase and our services and

solutions increase utilization of the equipment.

Accordingly, we expect 2004 total revenues to be in

line with 2003 levels.

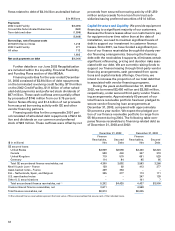

Segment Operating Profit:

Segment operating profit and operating margin for

each of the three years ended December 31, 2003 were

as follows:

Production: 2003 operating profit declined $28 million

from 2002, reflecting lower gross margins related to

initial installations of DocuColor iGen3 and Xerox

2101. The decrease in gross margins was only partially

offset by lower R&D and SAG expenses. 2002 operat-

ing profit improved $78 million from 2001, reflecting

gross margin improvements and lower SAG expense,

including reduced bad debt levels.

Office: 2003 operating profit improved $132 million

from 2002, reflecting improved gross margins driven

primarily by improved manufacturing and service pro-

ductivity, as well as lower R&D and SAG expenses.

2002 operating profit improved by $194 million from

2001 as we focused on more profitable revenue,

improved our manufacturing and service productivity

and reduced SAG expenses.

DMO: 2003 operating profit improved $60 million from

2002 due to significantly lower SAG spending resulting

from our cost saving initiatives, lower bad debts and

gains on currency exposures compared to currency

exposure losses in 2002. These improvements were

partially offset by lower gross margins as a result of

declining post sale revenue. 2002 operating profit

improved by $188 million from the 2001 operating loss

due to reduced SAG spending resulting from our cost

base restructuring actions and lower bad debt levels,

as well as significant gross margin improvement driv-

en by our focus on profitability. DMO refined its busi-

ness model in 2002 by transitioning equipment

financing to third parties, improving credit policies

and implementing additional cost reduction actions.

Other: 2003 Other segment operating loss of $411 mil-

lion increased by $82 million from 2002, principally

due to the loss on early extinguishment of debt of

$73 million and lower SOHO profit of $39 million as our

supplies sales declined following our exit from this

business. In addition, 2002 included benefits of $33 mil-

lion related to the ESOP expense adjustment and $50

million of profit related to a licensing agreement. These

amounts were partially offset by the write-off of internal

use software of $106 million in 2002.

2002 Other segment loss of $329 million

decreased by $69 million from 2001, principally due to

our exit from SOHO in the second half of 2001, which

improved results by $272 million on a year over year

basis. Operating results were also favorably impacted

by lower non-financing interest expense of $49 mil-

lion, the $33 million beneficial year over year impact

of the ESOP expense adjustment and the $50 million

profit from the licensing agreement. These amounts

were offset by several items, including the write-off of

internal use software of $106 million, higher pension

and benefit expense of $93 million and higher adver-

tising expenses of $62 million.

Employee Stock Ownership Plan (ESOP): In 2002,

our Board of Directors reinstated the dividend on our

ESOP, which resulted in a reversal of previously

recorded compensation expense. The reversal of

compensation expense corresponded to the line item

in the Consolidated Statement of Income for 2002

where the charge was originally recorded and includ-

ed $28 million in both Cost of Sales and Selling,

administrative and general expenses and $11 million

in Research and Development expenses. Of the total

compensation expense originally recorded, $34 mil-

lion and $33 million was recognized in 2002 and 2001,

respectively. As such, 2002 benefited by the reversal of

$33 million of excess compensation expense that was

originally recorded in 2001. There is no corresponding

earnings per share improvement in 2002 since the EPS

calculation requires deduction of dividends declared

from reported net income in arriving at net income

available to common shareholders. See Note 12 to

the Consolidated Financial Statements for a more

complete discussion of the ESOP, including current

funding status.

($ in millions) Production Office DMO Other Total

2003

Operating Profit $422 $753 $151 $(411) $915

Operating Margin 9.3% 9.8% 9.3% (22.4%) 5.8%

2002

Operating Profit $450 $621 $91 $(329) $833

Operating Margin 10.0% 8.2% 5.2% (16.2%) 5.3%

2001

Operating Profit $372 $427 $(97) $(398) $304

Operating Margin 7.9% 5.3% (4.8%) (17.8%) 1.8%