Xerox 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

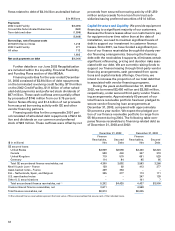

base rate plus a spread that varies between 0.75 per-

cent and 2 percent) depending on the then-current

leverage ratio, as defined, in the 2003 Credit Facility.

This rate was 3.42 percent at December 31, 2003.

The 2003 Credit Facility contains affirmative and

negative covenants including limitations on: issuance

of debt and preferred stock; investments and acquisi-

tions; mergers; certain transactions with affiliates; cre-

ation of liens; asset transfers; hedging transactions;

payment of dividends and certain other payments and

intercompany loans. The 2003 Credit Facility contains

financial maintenance covenants, including minimum

EBITDA, as defined, maximum leverage (total adjusted

debt divided by EBITDA), annual maximum capital

expenditures limits and minimum consolidated net

worth, as defined. These covenants are more fully dis-

cussed in Note 10.

The 2003 Credit Facility generally does not affect

our ability to continue to securitize receivables under

additional or existing third-party vendor financing

arrangements. Subject to certain exceptions, we can-

not pay cash dividends on our common stock during

the term of the 2003 Credit Facility, although we can

pay cash dividends on our preferred stock, provided

there is then no event of default under the 2003 Credit

Facility. Among defaults customary for facilities of this

type, defaults on our other debt, bankruptcy of certain

of our legal entities, or a change in control of Xerox

Corporation, would all constitute events of default

under the 2003 Credit Facility.

2010 and 2013 Senior Notes: We issued $700 million

aggregate principal amount of Senior Notes due

2010 and $550 million aggregate principal amount of

Senior Notes due 2013 in connection with the June

2003 Recapitalization. Interest on the Senior Notes due

2010 and 2013 accrues at the rate of 7.125 percent and

7.625 percent, respectively, per year and is payable

semiannually on each June 15 and December 15. In

conjunction with the issuance of the 2010 and 2013

Senior Notes, debt issuance costs of $32 million were

deferred. These notes, along with our Senior Notes

due 2009, are guaranteed by our wholly-owned sub-

sidiaries Intelligent Electronics, Inc. and Xerox

International Joint Marketing, Inc. Financial informa-

tion of these guarantors is included in Note 19 to the

Consolidated Financial Statements. The senior notes

also contain negative covenants (but no financial

maintenance covenants) similar to those contained in

the 2003 Credit Facility. However, they generally

provide us with more flexibility than the 2003 Credit

Facility covenants, except that payment of cash

dividends on the 6.25 percent Series C Mandatory

Convertible Preferred Stock is subject to certain

conditions. See Note 10 to the Consolidated Financial

Statements for a description of the covenants.

Financing Business: We implemented third-party ven-

dor financing programs in the United States, Canada,

the U.K., France, The Netherlands, the Nordic coun-

tries, Italy, Brazil and Mexico through major initiatives

with GE, Merrill Lynch and other third-party vendors

to fund our finance receivables in these countries.

These initiatives include the completion of the U.S.

Loan Agreement with General Electric Capital

Corporation (“GECC”) (the “Loan Agreement”). See

Note 4 to the Consolidated Financial Statements for a

discussion of our vendor financing initiatives.

GECC U.S. Secured Borrowing Arrangement: In

October 2002, we finalized an eight-year Loan

Agreement with GECC. The Loan Agreement provides

for a series of monthly secured loans up to $5 billion

outstanding at any time ($2.6 billion outstanding at

December 31, 2003). The $5 billion limit may be

increased to $8 billion subject to agreement between

the parties. Additionally, the agreement contains

mutually agreed renewal options for successive two-

year periods. The Loan Agreement, as well as similar

loan agreements with GE in the U.K. and Canada,

incorporates the financial maintenance covenants

contained in the 2003 Credit Facility and contains

other affirmative and negative covenants.

Under the Loan Agreement, we expect GECC to

fund a significant portion of new U.S. lease origina-

tions at over-collateralization rates, which vary over

time, but are expected to approximate 10 percent at

the inception of each funding. The securitizations are

subject to interest rates calculated at each monthly

loan occurrence at yield rates consistent with average

rates for similar market based transactions. The funds

received under this agreement are recorded as

secured borrowings and the associated finance receiv-

ables are included in our Consolidated Balance Sheet.

GECC’s commitment to fund under this agreement is

not subject to our credit ratings.

Loan Covenants and Compliance: At December 31,

2003, we were in full compliance with the covenants

and other provisions of the 2003 Credit Facility, the

senior notes and the Loan Agreement and expect to

remain in full compliance for at least the next twelve

months. Any failure to be in compliance with any

material provision or covenant of the 2003 Credit

Facility or the senior notes could have a material

adverse effect on our liquidity and operations. Failure

to be in compliance with the covenants in the Loan

Agreement, including the financial maintenance

covenants incorporated from the 2003 Credit Facility,

would result in an event of termination under the Loan

Agreement and in such case GECC would not be

required to make further loans to us. If GECC were to

make no further loans to us and assuming a similar

facility was not established, it would materially

adversely affect our liquidity and our ability to fund our

customers’ purchases of our equipment and this could