Xerox 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

recognize a material accrual, or should any of these

matters result in a final adverse judgment or be settled

for significant amounts, they could have a material

adverse effect on our results of operations, cash flows

and financial position in the period or periods in which

such change in determination, judgment or settlement

occurs. In 2003, we recorded a charge of $239 million

reflecting the court approved settlement of the Berger

pension related litigation.

Summary of Results:

Our reportable segments are consistent with how we

manage the business and view the markets we serve.

Our reportable segments are Production, Office, DMO

and Other. Our offerings include hardware, services,

solutions and consumable supplies. The Production

segment includes black and white products which oper-

ate at speeds over 90 pages per minute and color prod-

ucts over 40 pages per minute. Products include the

DocuTech, DocuPrint, Xerox 1010 and Xerox 2101 and

DocuColor families, as well as older technology light-

lens products. The Office segment includes black and

white products which operate at speeds up to 90 pages

per minute and color devices which operate at speeds

up to 40 pages per minute. Products include our family

of Document Centre digital multifunction products

which were expanded to include our new suite of

CopyCentre, WorkCentre, and WorkCentre Pro digital

multifunction systems, DocuColor multifunction prod-

ucts, color laser, solid ink and monochrome laser desk-

top printers, digital and light-lens copiers and facsimile

products. The DMO segment includes our operations in

Latin America, the Middle East, India, Eurasia, Russia

and Africa. This segment includes sales of products that

are typical to the Production and Office segments; how-

ever, management serves and evaluates these markets

on an aggregate geographic basis, rather than on a

product basis. The segment classified as Other, includes

several units, none of which met the thresholds for sep-

arate segment reporting. This group includes Xerox

Supplies Group (predominantly paper), SOHO, Xerox

Engineering Systems (“XES”), Xerox Technology

Enterprises and consulting services, royalty and license

revenues. Other segment profit (loss) includes the oper-

ating results from these entities, other less significant

businesses, our equity income from Fuji Xerox, and

certain costs which have not been allocated to the

Production, Office and DMO segments including non-

financing interest and other corporate costs.

Revenues:

Revenues by segment for the years ended 2003, 2002

and 2001 were as follows:

Equipment Sales:

2003 Equipment sales of $4.3 billion increased 7 per-

cent from 2002, reflecting significant growth in DMO,

the success of numerous new product introductions

and a 6-percentage point benefit from currency. In

2003, approximately 50 percent of equipment sales

were generated from products launched in the previ-

ous two years. Color equipment sales represented

28 percent of total equipment sales compared with

24 percent in 2002. 2002 equipment sales of $4.0 bil-

lion declined 10 percent from 2001, including a one

percentage point benefit from currency, as continued

economic weakness and competitive pressures more

than offset the successful impact of new products, most

of which were launched in the second half of 2002.

Production: 2003 equipment sales grew 9 percent from

2002, as improved product mix, installation growth and

favorable currency of 7 percent more than offset price

declines of approximately 5 percent. Strong 2003

production color equipment sales growth reflected

increased installations and stronger product mix driven

by the DocuColor 6060 and DocuColor iGen3 products.

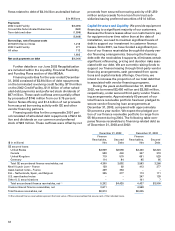

(in millions) Production Office DMO Other Total

2003

Equipment sales $1,201 $2,452 $ 425 $ 172 $ 4,250

Post sale and other revenue 2,970 4,656 1,182 1,646 10,454

Finance income 376 595 9 17 997

Total Revenue $4,547 $7,703 $1,616 $1,835 $15,701

2002

Equipment sales $1,100 $2,336 $ 334 $ 200 $ 3,970

Post sale and other revenue 3,028 4,604 1,408 1,839 10,879

Finance income 394 601 16 (11) 1,000

Total Revenue $4,522 $7,541 $1,758 $2,028 $15,849

2001

Equipment sales $1,196 $2,458 $ 321 $ 428 $ 4,403

Post sale and other revenue 3,092 4,898 1,679 1,807 11,476

Finance income 439 661 26 3 1,129

Total Revenue $4,727 $8,017 $2,026 $2,238 $17,008