Xerox 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

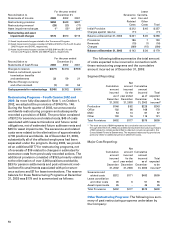

2003 2002 2001

Net income (loss) – as reported $ 360 $ 91 $ (94)

Deduct: Total stock-based

employee compensation

expense determined under

fair value based method

for all awards, net of tax (85) (83) (93)

Net income (loss) – pro forma $ 275 $ 8 $ (187)

Basic EPS – as reported $0.38 $ 0.02 $(0.15)

Basic EPS – pro forma 0.27 (0.09) (0.28)

Diluted EPS – as reported $0.36 $ 0.02 $(0.15)

Diluted EPS – pro forma 0.25 (0.09) (0.28)

The pro forma periodic compensation expense

amounts may not be representative of future amounts

since the estimated fair value of stock options is amor-

tized to expense ratably over the vesting period, and

additional options may be granted in future years. As

reflected in the pro forma amounts in the previous

table, the weighted-average fair value of each option

granted in 2003, 2002 and 2001 was $5.39, $6.34 and

$2.40, respectively. The fair value of each option was

estimated on the date of grant using the following

weighted average assumptions:

2003 2002 2001

Risk-free interest rate 3.3% 4.8% 5.1%

Expected life in years 7.2 6.5 6.5

Expected price volatility 66.2% 61.5% 51.4%

Expected dividend yield – – 2.7%

Foreign Currency Translation: The functional currency

for most foreign operations is the local currency. Net

assets are translated at current rates of exchange, and

income, expense and cash flow items are translated at

the average exchange rate for the year. The translation

adjustments are recorded in Accumulated Other

Comprehensive Income. The U.S. dollar is used as the

functional currency for certain subsidiaries that conduct

their business in U.S. dollars or operate in hyperinfla-

tionary economies. A combination of current and his-

torical exchange rates is used in remeasuring the local

currency transactions of these subsidiaries, and the

resulting exchange adjustments are included in income.

Aggregate foreign currency losses were $11 and $77 in

2003 and 2002, respectively, and gains were $29 in

2001 and are included in Other expenses, net in the

accompanying Consolidated Statements of Income.

Note 2 – Restructuring Programs

We have engaged in a series of restructuring programs

related to downsizing our employee base, exiting cer-

tain businesses, outsourcing certain internal functions

and engaging in other actions designed to reduce our

cost structure and improve productivity. Management

continues to evaluate the business and, therefore,

there may be supplemental provisions for new plan

initiatives as well as changes in estimates to amounts

previously recorded, as payments are made or actions

are completed. Asset impairment charges were also

incurred in connection with these restructuring actions

for those assets made obsolete or redundant as a

result of these programs. The restructuring and asset

impairment charges in the Consolidated Statements of

Income totaled $176, $670 and $715 in 2003, 2002 and

2001, respectively. Detailed information related to

restructuring program activity during the three years

ended December 31, 2003 is outlined below.

Fourth

Quarter

2002/2003 Turnaround 1998/ 2000

Restructuring Activity Program Program SOHO Programs TOTAL

Ending Balance December 31, 2000 $ – $ 71 $ – $ 256 $ 327

Provision – 401 101 85 587

Reversals of prior accruals – (26) (26) (25) (77)

Charges against reserve and currency – (223) (52) (280) (555)

Ending Balance December 31, 2001 $ – $ 223 $ 23 $ 36 $ 282

Provision 357 286 – 5 648

Reversals of prior accruals – (33) – – (33)

Charges against reserve and currency (71) (345) (17) (41) (474)

Ending Balance December 31, 2002 $ 286 $ 131 $ 6 $ – $ 423

Provision 193 11 – – 204

Reversals of prior accruals (16) (13) – – (29)

Charges against reserve and currency (284) (87) (6) – (377)

Ending Balance December 31, 2003 $ 179 $ 42 $ – $ – $ 221