Xerox 2003 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

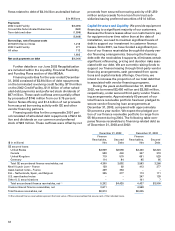

22

changes in demand or technological developments

could materially impact the value of our inventory and

our reported operating results if our estimates prove

to be inaccurate. We recorded $78 million, $115 mil-

lion, and $242 million in inventory write-down charges

for the years ended December 31, 2003, 2002 and 2001,

respectively. The decline in inventory write-down

charges is due to the absence of business exiting activ-

ities, stabilization of our product lines, manufacturing

outsourcing related improvements and a lower level

of inventories.

As discussed above, in preparing our financial

statements for the three years ended December 31,

2003, we estimated our provision for excess and obso-

lete inventories based primarily on forecasts of pro-

duction and service requirements. We believe this

methodology is appropriate. During the three year

period ended December 31, 2003, inventory reserves

for net realizable value adjustments as a percentage of

gross inventory varied by approximately one percent-

age point. Holding all other assumptions constant, a

0.5 percentage point increase or decrease in our net

realizable value adjustments would change the 2003

provision of $78 million by approximately $7 million.

Asset Valuations and Review for Potential

Impairments: Our long-lived assets, excluding good-

will, are assessed for impairment by comparison of

the total amount of undiscounted cash flows expected

to be generated by such assets to their carrying value.

We periodically review our long-lived assets, whereby

we make assumptions regarding the valuation and the

changes in circumstances that would affect the carry-

ing value of these assets. If such analysis indicates

that an impairment exists, we are then required to

estimate the fair value of the asset and, as appropriate,

expense all or a portion of the asset, based on a com-

parison to the net book value of such asset or group of

assets. The determination of fair value includes inher-

ent uncertainties, such as the impact of competition

on future value. Our primary methodology for deter-

mining fair value is based on a discounted cash flow

model. We believe that we have made reasonable esti-

mates and judgments in determining whether our

long-lived assets have been impaired; however, if

there is a material change in the assumptions used in

our determination of fair values or if there is a material

change in economic conditions or circumstances influ-

encing fair value, we could be required to recognize

certain impairment charges in the future. During 2002,

due to our decision to abandon the use of certain soft-

ware applications, we recorded an impairment charge

of $106 million in Selling, administrative and general

expenses in the accompanying Consolidated

Statement of Income. In addition, we recorded asset

impairment charges in connection with our restructur-

ing actions of $1 million, $55 million, and $205 million

in 2003, 2002, and 2001, respectively.

Goodwill and Other Acquired Intangible Assets: We

have made acquisitions in the past that included the

recognition of a significant amount of goodwill and

other intangible assets. Commencing January 1, 2002,

goodwill is no longer amortized, but instead is

assessed for impairment annually or more frequently

as triggering events occur that indicate a decline in fair

value below that of its carrying value. In making these

assessments, we rely on a number of factors including

operating results, business plans, economic projec-

tions, anticipated future cash flows and market compa-

rable data. There are inherent uncertainties related to

these factors and our judgment, including the risk that

the carrying value of our goodwill may be overstated

or understated. In 2002, we recognized an impairment

charge of $63 million related to the goodwill in our

DMO segment, which was recorded as a cumulative

effect of a change in accounting principle in the accom-

panying Consolidated Statements of Income.

Pension and Post-retirement Benefit Plan

Assumptions: We sponsor pension plans in various

forms in several countries covering substantially all

employees who meet eligibility requirements. Post-

retirement benefit plans cover primarily U.S. employ-

ees for retirement medical costs. Several statistical

and other factors that attempt to anticipate future

events are used in calculating the expense, liability

and asset values related to our pension and post-

retirement benefit plans. These factors include

assumptions we make about the discount rate, expect-

ed return on plan assets, rate of increase in healthcare

costs, the rate of future compensation increases and

mortality, among others. For purposes of determining

the expected return on plan assets, we utilize a calcu-

lated value approach in determining the value of the

pension plan assets, as opposed to a fair market value

approach. The primary difference between the two

methods relates to a systematic recognition of

changes in fair value over time (generally two years)

versus immediate recognition of changes in fair value.

Our expected rate of return on plan assets is then

applied to the calculated asset value to determine the

amount of the expected return on plan assets to be

used in the determination of the net periodic pension

cost. The calculated value approach reduces the

volatility in net periodic pension cost that results from

using the fair market value approach. The difference

between the actual return on plan assets and the

expected return on plan assets is added to, or sub-

tracted from, any cumulative differences that arose in

prior years. This amount is a component of the unrec-

ognized net actuarial (gain) loss and is subject to

amortization to net periodic pension cost over the

average remaining service lives of the employees par-

ticipating in the pension plan.

As a result of cumulative asset returns being lower

than expected asset returns over the last several years