Xerox 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

materially adversely affect our results of operations.

We have the right at any time to prepay any loans out-

standing under or terminate the 2003 Credit Facility.

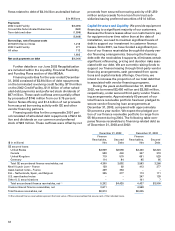

Credit Ratings: Our credit ratings as of February 27,

2004 were as follows:

Senior

Unsecured

Debt Outlook Comments

Moody’s(1) B1 Stable The Moody’s rating was

upgraded from B1

(with a negative outlook)

in December 2003.

S&P B+ Negative The S&P rating on Senior

Secured Debt is BB-.

Fitch BB Stable The Fitch rating was upgraded

from BB- (with a negative

outlook) in June 2003.

(1) In December 2003, Moody’s assigned to Xerox a first time SGL-1 rating.

Our ability to obtain financing and the related cost

of borrowing is affected by our debt ratings, which are

periodically reviewed by the major credit rating agen-

cies. Our current credit ratings are below investment

grade and we expect our access to the public debt

markets to be limited to the non-investment grade

segment until our ratings have been restored.

Specifically, until our credit ratings improve, it is

Other Commercial Commitments and

Contingencies:

Pension and Other Post-Retirement Benefit Plans: We

sponsor pension and other post-retirement benefit

plans that require periodic cash contributions. Our

2003 cash fundings for these plans were $672 million

for pensions and $101 million for other post-retire-

ment plans. Our anticipated cash fundings for 2004 are

$63 million for pensions and $114 million for other

post-retirement plans. Cash contribution requirements

for our domestic tax qualified pension plans are gov-

erned by the Employment Retirement Income Security

Act (ERISA) and the Internal Revenue Code. Cash con-

tribution requirements for our international plans are

subject to the applicable regulations in each country.

The expected contributions for pensions for 2004 of

$63 million include no expected contributions to the

domestic tax qualified plans because these plans have

already exceeded the ERISA minimum funding

requirements for the plans’ 2003 plan year due to

funding of approximately $450 million in 2003. Of this

amount, $325 million was accelerated or in excess of

required amounts. Our post-retirement plans are non-

funded and are almost entirely related to domestic

operations. Cash contributions are made each year to

cover medical claims costs incurred in that year.

Flextronics: As previously discussed, in 2001 we out-

sourced certain manufacturing activities to Flextronics

under a five-year agreement. During 2003, we pur-

chased approximately $910 million of inventory from

Flextronics. We anticipate that we will purchase

approximately $915 million of inventory from

unlikely we will be able to access the low-interest

commercial paper markets or to obtain unsecured

bank lines of credit.

Summary – Financial Flexibility and Liquidity: With

$2.5 billion of cash and cash equivalents on hand at

December 31, 2003 and borrowing capacity under our

2003 Credit Facility of $700 million, less $51 million uti-

lized for letters of credit, we believe our liquidity

(including operating and other cash flows that we

expect to generate) will be sufficient to meet operating

cash flow requirements as they occur and to satisfy all

scheduled debt maturities for at least the next twelve

months. Our ability to maintain positive liquidity going

forward depends on our ability to continue to generate

cash from operations and access to the financial mar-

kets, both of which are subject to general economic,

financial, competitive, legislative, regulatory and other

market factors that are beyond our control. We cur-

rently have a $2.5 billion shelf registration that enables

us to access the market on an opportunistic basis and

offer both debt and equity securities.

Contractual Cash Obligations and Other Commercial

Commitments and Contingencies: At December 31,

2003, we had the following contractual cash obliga-

tions and other commercial commitments and contin-

gencies ($ in millions):

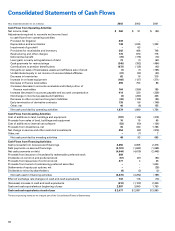

Year 1 Years 2-3 Years 4-5 There-

2004 2005 2006 2007 2008 after

Long-term debt, including capital lease obligations(1) $4,194 $2,129 $486 $775 $782 $2,758

Minimum operating lease commitments(2) 235 190 148 118 96 383

Liabilities to subsidiary trusts issuing preferred securities(3) 1,067 – 77 – – 665

Total contractual cash obligations $5,496 $2,319 $711 $893 $878 $3,806

(1) Refer to Note 10 to our Consolidated Financial Statements for additional information related to long-term debt (amounts include principal portion only).

(2) Refer to Notes 5 and 6 to our Consolidated Financial Statements for additional information related to minimum operating lease commitments.

(3) Refer to Note 14 to our Consolidated Financial Statements for additional information related to liabilities to subsidiary trusts issuing preferred securities

(amounts include principal portion only). The amounts shown above correspond to the year in which the preferred securities can first be put to us. We have

the option to settle the 2004 amounts in stock if such loan is put to us.