Xerox 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

sales to governmental units. Governmental units are

those entities that have statutorily defined funding or

annual budgets that are determined by their legislative

bodies. Certain of our governmental contracts may

have cancellation provisions or renewal clauses that

are required by law, such as 1) those dependant on

fiscal funding outside of a governmental unit’s control,

2) those that can be cancelled if deemed in the taxpay-

er’s best interest or 3) those that must be renewed each

fiscal year, given limitations that may exist on entering

multi-year contracts that are imposed by statute. In

these circumstances and in accordance with the rele-

vant accounting literature, we carefully evaluate these

contracts to assess whether cancellation is remote

because of the existence of substantive economic

penalties upon cancellation or whether the renewal is

reasonably assured due to the existence of a bargain

renewal option. The evaluation of a lease agreement

with a renewal option includes an assessment as to

whether the renewal is reasonably assured based on

the intent of such governmental unit and pricing terms

as compared to those of short-term leases at lease

inception. We further ensure that the contract provi-

sions described above are offered only in instances

where required by law. Where such contract terms are

not legally required, we consider the arrangement to

be cancelable and account for it as an operating lease.

Aside from the initial lease of equipment to our

customers, we may enter subsequent transactions

with the same customer whereby we extend the term.

We evaluate the classification of lease extensions of

sales-type leases using the originally determined eco-

nomic life for each product. There may be instances

where we enter into lease extensions for periods that

are within the original economic life of the equipment.

These are accounted for as sales-type leases only

when the extensions occur in the last three months of

the lease term and they otherwise meet the appropri-

ate criteria of SFAS 13. All other lease extensions of

this type are accounted for as direct financing leases

or operating leases, as appropriate.

Cash and Cash Equivalents: Cash and cash equivalents

consist of cash on hand, including money-market

funds, and investments with original maturities of

three months or less.

Restricted Cash and Investments: Several of our

borrowing and derivative contracts, as well as other

material contracts, require us to post cash collateral

or maintain minimum cash balances in escrow. These

cash amounts are reported in our Consolidated

Balance Sheets within Other current assets or Other

long-term assets, depending on when the cash will

be contractually released. At December 31, 2003 and

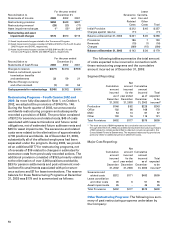

2002, such restricted cash amounts were as follows:

December 31,

2003 2002

Escrow and cash collections

related to secured borrowing

arrangements $462 $349

Escrow related to liability to trusts

issuing preferred securities 79 155

Collateral related to swaps and

letters of credit 74 77

Other restricted cash 114 97

Total $729 $678

Of these amounts, $386 and $263 were included in

Other current assets and $343 and $415 were included

in Other long-term assets, as of December 31, 2003

and 2002, respectively. The current amounts are

expected to be available for our use within one year.

Provisions for Losses on Uncollectible Receivables:

The provisions for losses on uncollectible trade and

finance receivables are determined principally on the

basis of past collection experience applied to ongoing

evaluations of our receivables and evaluations of the

default risks of repayment. Allowances for doubtful

accounts on accounts receivable balances were $218

and $282, as of December 31, 2003 and 2002, respec-

tively. Allowances for doubtful accounts on finance

receivables were $315 and $324 at December 31, 2003

and 2002, respectively.

Inventories: Inventories are carried at the lower of

average cost or market. Inventories also include equip-

ment that is returned at the end of the lease term.

Returned equipment is recorded at the lower of

remaining net book value or salvage value. Salvage

value consists of the estimated market value (general-

ly determined based on replacement cost) of the sal-

vageable component parts, which are expected to be

used in the remanufacturing process. We regularly

review inventory quantities and record a provision for

excess and/or obsolete inventory based primarily on

our estimated forecast of product demand, production

requirements and servicing commitments. Several fac-

tors may influence the realizability of our inventories,

including our decision to exit a product line, techno-

logical changes and new product development. The

provision for excess and/or obsolete raw materials and

equipment inventories is based primarily on near term

forecasts of product demand and include considera-

tion of new product introductions as well as changes

in remanufacturing strategies. The provision for

excess and/or obsolete service parts inventory is

based primarily on projected servicing requirements

over the life of the related equipment populations.