Xerox 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

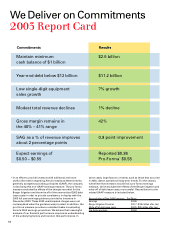

We Deliver on Commitments

20

03 Report Card

* In an effort to provide investors with additional and more

useful information regarding Xerox’s results as determined by

generally accepted accounting principles (GAAP), the company

is disclosing this non-GAAP earnings measure. The pro-forma

measure excludes the effects of the charges recorded for the

Berger litigation and the write-off of the unamortized 2002 debt

issue costs in order to provide consistency in display with the

2003 full year earnings guidance provided to investors in

November 2002. These 2003 unanticipated charges were not

contemplated when the guidance was provided. In addition, the

pro-forma measure provides a consistent basis in evaluating

Xerox’s 2004 earnings projections. We believe that meaningful

analysis of our financial performance requires an understanding

of the underlying factors and trends in that performance. In

some cases, large factors or events, such as those that occurred

in 2003, distort operational long-term trends. For this reason,

we believe that investors would find a pro-forma earnings

measure, which excludes the effects of the Berger litigation and

write-off of debt issue costs, more useful. Reconciliation to the

related GAAP measure is included below.

Reconciliation of Non-GAAP measure Per/Share

Earnings $ 0.36

Berger Litigation Provision $ 0.17 ($146 million after-tax)

Write-off of debt issue costs $ 0.05 ($45 million after-tax)

Pro-forma earnings $ 0.58

Commitments Results

Maintain minimum $2.5 billion

cash balance of $1 billion

Year-end debt below $12 billion $11.2 billion

Low single-digit equipment 7% growth

sales growth

Modest total revenue declines 1% decline

Gross margin remains in 42%

the 40% – 41% range

SAG as a % of revenue improves 0.9 point improvement

about 2 percentage points

Expect earnings of Reported $0.36

$0.50 – $0.55 Pro-Forma*$0.58

16