Xerox 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

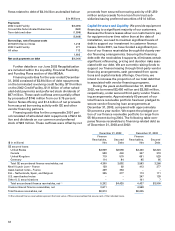

Income Taxes: The following table summarizes our

consolidated income taxes and the related effective

tax rate for each respective period:

Year Ended December 31,

($ in millions) 2003 2002 2001

Pre-tax income $436 $104 $328

Income taxes 134 4 473

Effective tax rate (1) 30.7% 3.8% 144.2%

(1) A detailed reconciliation of the consolidated effective tax rate to the U.S.

federal statutory income tax rate is included in Note 13.

The difference between the 2003 consolidated

effective tax rate of 30.7 percent and the U.S. federal

statutory income tax rate of 35 percent relates primarily

to $35 million of tax benefits arising from the reversal

of valuation allowances on deferred tax assets follow-

ing a re-evaluation of their future realization due to

improved financial performance, other foreign adjust-

ments, including earnings taxed at different rates, the

impact of Series B Convertible Preferred Stock divi-

dends and state tax benefits. Such benefits were par-

tially offset by tax expense for audit and other tax

return adjustments, as well as $19 million of unrecog-

nized tax benefits primarily related to recurring losses

in certain jurisdictions where we continue to maintain

deferred tax asset valuation allowances.

The difference between the 2002 consolidated

effective tax rate of 3.8 percent and the U.S. federal

statutory income tax rate of 35 percent relates primari-

ly to the recognition of tax benefits resulting from the

favorable resolution of a foreign tax audit of approxi-

mately $79 million, tax law changes of approximately

$26 million and the impact of Series B Convertible

Preferred Stock dividends. Such benefits were offset,

in part, by tax expense recorded for the on-going

examination in India, the sale of our interest in Katun

Corporation, as well as recurring losses in certain

jurisdictions where we are not providing tax benefits

and continue to maintain deferred tax asset valuation

allowances.

The difference between the 2001 consolidated

effective tax rate of 144.2 percent and the U.S. federal

statutory income tax rate of 35 percent relates primari-

ly to the recognition of deferred tax asset valuation

allowances of $247 million from our recoverability

assessments, the taxes incurred in connection with the

sale of our partial interest in Fuji Xerox and recurring

losses in low tax jurisdictions. The gain for tax purpos-

es on the sale of Fuji Xerox was disproportionate to

the gain for book purposes as a result of a lower tax

basis in the investment. Other items favorably impact-

ing the tax rate included a tax audit resolution of

approximately $140 million and additional tax benefits

arising from prior period restructuring provisions.

Our consolidated effective income tax rate will

change based on discrete events (such as audit settle-

ments) as well as other factors including the geo-

graphical mix of income before taxes and the related

tax rates in those jurisdictions. We anticipate that our

2004 annual consolidated effective tax rate will

approximate 40 percent.

Equity in Net Income of Unconsolidated Affiliates:

Equity in net income of unconsolidated affiliates is

principally related to our 25 percent share of Fuji Xerox

income. Our 2003 equity in net income of $58 million

was comparable with 2002 and 2001 results of $54 mil-

lion and $53 million, respectively.

Recent Accounting Pronouncements: See Note 1 of

the Consolidated Financial Statements for a full

description of recent accounting pronouncements

including the respective dates of adoption and effects

on results of operations and financial condition.

Capital Resources and Liquidity:

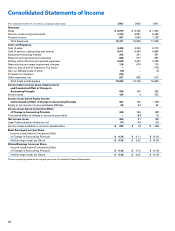

Cash Flow Analysis: The following summarizes our

cash flows for the each of the three years ended

December 31, 2003, as reported in our Consolidated

Statements of Cash Flows in the accompanying

Consolidated Financial Statements:

($ in millions) 2003 2002 2001

Net cash provided by

operating activities $1,879 $1,980 $1,754

Net cash provided by

investing activities 49 93 685

Net cash used in

financing activities (2,470) (3,292) (189)

Effect of exchange rate

changes on cash 132 116 (10)

(Decrease) increase in cash

and cash equivalents (410) (1,103) 2,240

Cash and cash equivalents

at beginning of year 2,887 3,990 1,750

Cash and cash equivalents

at end of year $2,477 $2,887 $3,990

Operating: For the year ended December 31, 2003,

operating cash flows of $1.9 billion reflect pre-tax

income of $436 million and the following non-cash

items: depreciation and amortization of $748 million,

provisions for receivables and inventory of $302 mil-

lion, the provision for the Berger litigation of $239 mil-

lion and a loss on early extinguishment of debt of

$73 million. In addition, operating cash flows were

enhanced by finance receivable reductions of $496

million, cash generated from the early termination of

interest rate swaps of $136 million, accounts receiv-

able reductions of $164 million, driven by improved

collection efforts and other working capital improve-

ments of over $600 million. The Finance receivable

reduction results from collections of finance receiv-

ables associated with prior year sales that exceed

receivables generated from recent equipment sales.