Xerox 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

The DocuColor iGen3 utilizes next generation color

technology which we expect will expand the digital

color print on demand market. 2003 production

monochrome equipment sales grew modestly as light-

production installations, driven by the success of the

new Xerox 2101 copier/printer, and favorable currency

more than offset declines in production publishing,

printing and older technology light lens. 2002 equip-

ment sales declined 8 percent from 2001 reflecting

price declines of approximately 5 percent, weaker

product mix and installation declines driven largely

by older technology light lens equipment.

Office: 2003 equipment sales grew 5 percent from

2002, as favorable currency of 7 percent and installa-

tion increases more than offset price declines of

approximately 10 percent and the impact of weaker

product mix. Equipment installation growth of approx-

imately 20 percent reflects growth in all monochrome

digital and color businesses, particularly office color

printing and our line of monochrome multifunction/

copier systems. The CopyCentre, WorkCentre and

WorkCentre Pro systems, which were launched in the

second quarter 2003, are intended to expand our mar-

ket reach and include new entry-level configurations

at more competitive prices. 2002 equipment sales

declined 5 percent from 2001, with approximately two-

thirds of the decline driven by older technology light

lens products. The remainder of the decline was due

to price declines of approximately 10 percent and

weaker product mix, which more than offset installa-

tion growth in our digital products.

DMO: 2003 equipment sales grew 27 percent from

2002, reflecting volume growth of over 40 percent,

partially offset by price declines of approximately 10

percent and unfavorable mix.

Other: 2003 equipment sales declined 14 percent from

2002 due to general sales declines, none of which

were individually significant. 2002 equipment sales

declined 53 percent from 2001, primarily reflecting our

exit from the SOHO business in 2001.

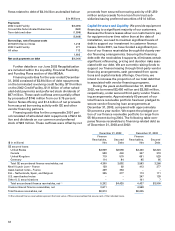

Post Sale and Other Revenue:

2003 post sale and other revenues of $10.5 billion

declined 4 percent from 2002, including a 5-percent-

age point benefit from currency. These declines reflect

lower equipment populations, as post sale revenue is

largely a function of the equipment placed at customer

locations and the volume of prints and copies that our

customers make on that equipment as well as associ-

ated services. 2003 supplies, paper and other sales of

$2.7 billion (included within post sale and other rev-

enue) declined 2 percent from 2002 primarily due to

declines in supplies. Supplies sales declined due to

reduced usage in the lower installed base of equip-

ment and our exit from the SOHO business in 2001.

2003 service, outsourcing and rental revenue of

$7.7 billion declined 4 percent from 2002, reflecting

declines in rental and facilities management revenues.

Declines in rental revenues primarily reflect reduced

equipment populations within DMO and declines in

facilities management revenues reflect consolidations

by our customers as well as our prioritization of prof-

itable contracts. 2002 post sale and other revenues of

$10.9 billion declined 5 percent from 2001. 2002 sup-

plies, paper and other sales of $2.8 billion declined

8 percent from 2001, primarily reflecting declines in

supplies. 2002 service, outsourcing and rental revenue

of $8.1 billion declined 4 percent from 2001 driven

primarily by lower rental revenues in DMO.

Production: 2003 post sale and other revenue declined

2 percent from 2002, as favorable currency and

improved mix, driven largely by an increased volume

of color pages, were more than offset by the impact of

monochrome page volume declines, primarily in older

technology light lens products. 2002 post sale and

other revenue declined 2 percent from 2001, as

declines in monochrome page volumes more than

offset the impact of improved mix due to significant

growth in color page volumes.

Office: 2003 post sale and other revenue grew 1 percent

from 2002, as favorable currency and strong digital

page growth more than offset declines in older tech-

nology light lens products. 2002 post sale and other

revenue declined 6 percent from 2001, as declines in

older technology light lens products more than offset

strong digital page growth.

DMO: 2003 post sale and other revenue declined

16 percent from 2002, due largely to a lower rental

equipment population at customer locations and relat-

ed page volume declines. 2002 post sale and other rev-

enue declined 16 percent from 2001, due to a reduction

in the amount of equipment installations at certain

DMO customer locations as a result of reduced place-

ments in prior periods.

Other: 2003 post sale and other revenue declined

10 percent from 2002, reflecting supply sale declines

in SOHO of $82 million as well as the absence of

$50 million of third-party licensing revenue recognized

in 2002. See Note 3 to the Consolidated Financial

Statements for further discussion.

We expect 2004 equipment sales will continue to

grow, as we anticipate that new products launched in

2002, 2003 and those planned in 2004 will enable us to

further strengthen our market position. Our ability to

increase post sale revenue is dependent on our suc-

cess at increasing the amount of our equipment at

customer locations and the volume of pages generat-

ed on that equipment. In 2004, we expect post sale

and other revenue declines will continue to moderate