Xerox 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

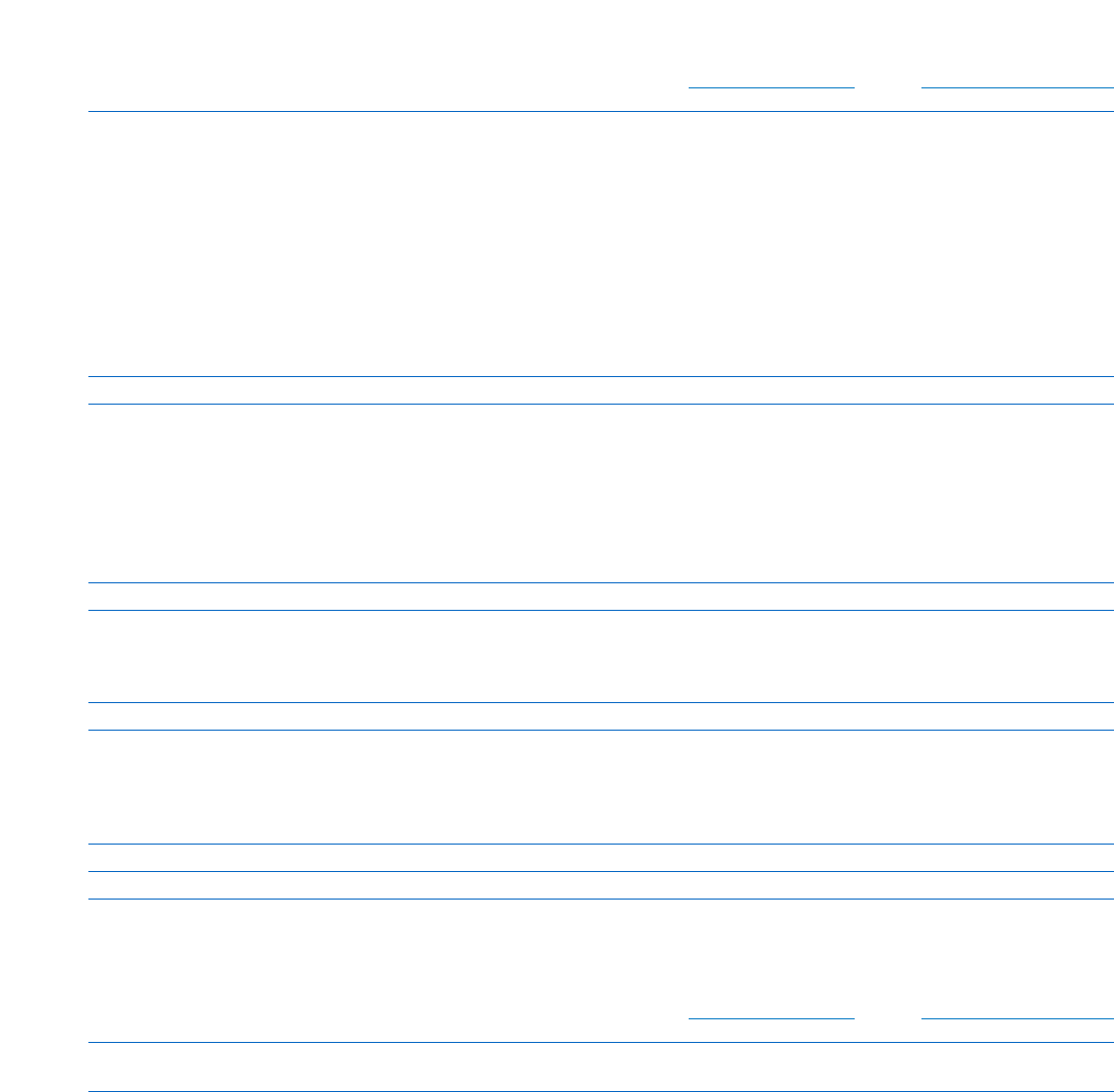

65

Pension Benefits Other Benefits

2003 2002 2003 2002

Change in Benefit Obligation

Benefit obligation, January 1 $7,931 $7,606 $1,563 $1,481

Service cost 197 180 26 26

Interest cost 934 (210) 91 96

Plan participants’ contributions 15 18 93

Plan amendments 1(31) (30) (139)

Actuarial loss 312 736 18 191

Currency exchange rate changes 486 327 12 –

Divestitures (45) (1) ––

Curtailments 12–8

Special termination benefits –39 –2

Benefits paid/settlements (861) (735) (110) (105)

Benefit obligation, December 31 $8,971 $7,931 $1,579 $1,563

Change in Plan Assets

Fair value of plan assets, January 1 $ 5,963 $ 7,040 $ – $ –

Actual return on plan assets 1,150 (768) ––

Employer contribution 672 138 101 102

Plan participants’ contributions 15 18 93

Currency exchange rate changes 401 271 ––

Divestitures (39) (1) ––

Benefits paid/settlements (861) (735) (110) (105)

Fair value of plan assets, December 31 $ 7,301 $ 5,963 $ – $ –

Funded status (including under-funded and non-funded plans) (1,670) (1,968) (1,579) (1,563)

Unamortized transition assets (2) –––

Unrecognized prior service cost (24) (27) (136) (134)

Unrecognized net actuarial loss 1,870 1,843 447 445

Net amount recognized $ 174 $ (152) $(1,268) $(1,252)

Amounts recognized in the Consolidated Balance Sheets consist of:

Prepaid benefit cost $ 756 $ 629 $ – $ –

Accrued benefit liability (850) (1,250) (1,268) (1,252)

Intangible asset 67––

Minimum pension liability included in AOCL 262 462 ––

Net amount recognized $ 174 $ (152) $(1,268) $(1,252)

Change in minimum liability included in AOCL $ (200) $ 406

Information for benefit plans that are under-funded

or non-funded on a Projected Benefit Obligation basis:

Pension Benefits Other Benefits

2003 2002 2003 2002

Aggregate projected benefit obligation $8,853 $7,865 $1,579 $1,563

Aggregate fair value of plan assets $7,164 $5,878 $ – $ –

The accumulated benefit obligation for all defined

benefit pension plans was $8,036 and $7,087 at

December 31, 2003, and 2002, respectively.