Xerox 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

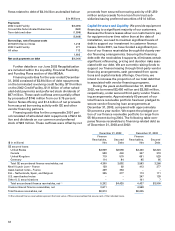

December 31, 2003 December 31, 2002

Finance Finance

Receivables, Secured Receivables, Secured

($ in millions) Net Debt Net Debt

GE secured loans:

United States $2,939 $2,598 $2,430 $2,323

Canada 528 440 347 319

United Kingdom 719 570 691 529

Germany 114 84 95 95

Total GE encumbered finance receivables, net 4,300 3,692 3,563 3,266

Merrill Lynch Loan – France 138 92 413 377

Asset-backed notes – France 429 364 – –

DLL – Netherlands, Spain, and Belgium 335 277 113 111

U.S. asset-backed notes – – 247 139

Other U.S. securitizations – – 101 7

Total encumbered finance receivables, net (1) 5,202 $4,425 4,437 $3,900

Unencumbered finance receivables, net 3,611 4,568

Total finance receivables, net $8,813 $9,005

(1) Encumbered finance receivables represent the book value of finance receivables that secure each of the indicated loans.

32

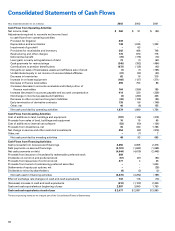

flows related to debt of $4.0 billion as detailed below:

$ In Millions

Payments

2002 Credit Facility $(3,490)

Convertible Subordinated Debentures (560)

Term debt and other (1,596)

(5,646)

Borrowings, net of issuance costs

2010/2013 Senior Notes 1,218

2003 Credit Facility 271

All other 113

1,602

Net cash payments on debt $(4,044)

Further details on our June 2003 Recapitalization

are included within the Liquidity, Financial Flexibility

and Funding Plans section of this MD&A.

Financing activities for the year ended December

31, 2002 consisted of $2.8 billion of debt repayments

on the terminated revolving credit facility, $710 million

on the 2002 Credit Facility, $1.9 billion of other sched-

uled debt payments and preferred stock dividends of

$67 million. These cash outflows were partially offset

by proceeds of $746 million from our 9.75 percent

Senior Notes offering and $1.4 billion of net proceeds

from secured borrowing activity with GE and other

vendor financing partners.

Financing activities for the comparable 2001 peri-

od consisted of scheduled debt repayments of $2.4 bil-

lion and dividends on our common and preferred

stock of $93 million. These outflows were offset by net

proceeds from secured borrowing activity of $1,350

million and proceeds from a loan from trust sub-

sidiaries issuing preferred securities of $1.0 billion.

Capital Structure and Liquidity: We provide equipment

financing to a significant majority of our customers.

Because the finance leases allow our customers to pay

for equipment over time rather than at the date of

installation, we need to maintain significant levels of

debt to support our investment in customer finance

leases. Since 2001, we have funded a significant por-

tion of our finance receivables through third-party ven-

dor financing arrangements. Securing the financing

debt with the receivables it supports, eliminates certain

significant refinancing, pricing and duration risks asso-

ciated with our debt. We are currently raising funds to

support our finance leasing through third-party vendor

financing arrangements, cash generated from opera-

tions and capital markets offerings. Over time, we

intend to increase the proportion of our total debt that

is associated with vendor financing programs.

During the years ended December 31, 2003 and

2002, we borrowed $2,450 million and $3,055 million,

respectively, under secured third-party vendor financ-

ing arrangements. Approximately 60 percent of our

total finance receivable portfolio has been pledged to

secure vendor financing loan arrangements at

December 31, 2003, compared with approximately

50 percent a year earlier. We expect the pledged por-

tion of our finance receivable portfolio to range from

55-60 percent during 2004. The following table com-

pares finance receivables to financing-related debt as

of December 31, 2003 and 2002: