Xerox 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

During 2003, we entered into similar long-term

lease funding arrangements with GE in both the U.K.

and Canada. These agreements contain similar terms

and conditions as those contained in the U.S. Loan

Agreement with respect to funding conditions and

covenants. The final funding date for all facilities is

currently December 2010. The following is a summary

of the facility amounts for the arrangements with GE

in these countries.

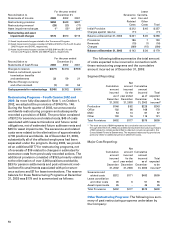

Facility Amount Maximum Facility Amount(1)

U.S. $5 billion $8 billion

U.K. £400 million £600 million

(U.S. $711) (U.S. $1.1 billion)

Canada Cdn. $850 million Cdn. $2 billion

(U.S. $657) (U.S. $1.5 billion)

(1) subject to mutual agreement by the parties

France Secured Borrowings: In July 2003, we securi-

tized receivables of $443, previously funded under a

364-day warehouse financing facility established in

December 2002 with subsidiaries of Merrill Lynch,

with a three-year public secured financing arrange-

ment. In addition, we established a new warehouse

financing facility to fund future lease originations in

France. This facility can provide funding for new lease

originations up to €350 million (U.S. $439), outstand-

ing at any time, and balances may be securitized

through a similar public offering within two years.

The Netherlands Secured Borrowings: Beginning in

the second half of 2002, we received a series of fund-

ings through our consolidated joint venture with De

Lage Landen International BV (DLL) from DLL’s parent,

De Lage Landen Ireland Company. The fundings are

secured by our lease receivables in The Netherlands

which were transferred to DLL. In addition, DLL also

became our primary equipment financing provider in

the Netherlands for all new lease originations. In the

fourth quarter of 2003, DLL expanded its operations

to include Spain and Belgium. As more fully discussed

in Note 1, our joint venture with DLL has been

consolidated.

Germany Secured Borrowings: In May 2002, we

entered into an agreement to transfer part of our

financing operations in Germany to GE. In conjunction

with this transaction, we received loans from GE

secured by lease receivables in Germany. As part of

the transaction we transferred leasing employees to a

GE entity which will also finance certain new leasing

business in the future. We currently consolidate this

joint venture since we retain substantive rights related

to the borrowings.

The following table shows finance receivables and

related secured debt as of December 31, 2003 and 2002:

December 31, 2003 December 31,2002

Finance Finance

Receiv- Receiv-

ables, Secured ables, Secured

Net Debt Net Debt

GE secured loans:

United States $2,939 $2,598 $2,430 $2,323

Canada 528 440 347 319

United Kingdom 719 570 691 529

Germany 114 84 95 95

Total GE encumbered

finance

receivables, net 4,300 3,692 3,563 3,266

Merrill Lynch Loan –

France 138 92 413 377

Asset-backed notes –

France 429 364 – –

DLL – Netherlands,

Spain, and Belgium(1) 335 277 113 111

U.S. asset-backed notes – – 247 139

Other U.S. securitizations – – 101 7

Total encumbered

finance

receivables, net 5,202 $4,425 4,437 $3,900

Unencumbered finance

receivables, net 3,611 4,568

Total finance

receivables, net $8,813 $9,005

(1) These represent the loans received by our consolidated joint venture with

DLL. De Lage Landen Ireland Company is the lender of record.

As of December 31, 2003, $5,202 of Finance receiv-

ables, net are held as collateral in various trusts as secu-

rity for the borrowings noted above. Total outstanding

debt secured by these receivables at December 31, 2003

was $4,425. The trusts are consolidated in our financial

statements. Although the transferred assets are included

in our total assets, the assets of the trusts are not avail-

able to satisfy any of our other obligations.

Sales of Accounts Receivable: In 2000, we established

two revolving accounts receivable securitization facili-

ties in the U.S. and Canada aggregating $330. The

facilities enabled us to sell, on an ongoing basis, undi-

vided interests in a portion of our accounts receivable

in exchange for cash. The undivided interest sold

under the U.S. trade receivable securitization facility

amounted to $290 at December 31, 2001. In May 2002,

a credit rating agency downgrade caused a termina-

tion event under our U.S. trade receivable securitiza-

tion facility. We continued to sell receivables into the

U.S trade receivable securitization facility pending

renegotiation of the facility as a result of this termina-

tion event. In October 2002, the facility was terminated

and no additional receivables were sold to the facility.

As a result, in October, the counter-party received $231

of collections from the pool of the then-existing receiv-