Western Union 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

transferees first and then obtain reimbursement from Western Union. Payment service payables represent

amounts to be paid to utility companies, auto finance companies, mortgage servicers, financial service

providers, government agencies and others. Due to the agent funding and settlement process, payables to

agents represent amounts due to agents for money transfers that have been settled with transferees.

In 2009, the Company’s settlement assets and obligations include assets and obligations transferred as a

result of the Company assuming the money order assets and obligations previously held by IPS. See Note 7

for information concerning the Company’s investment securities.

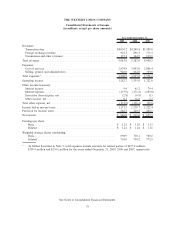

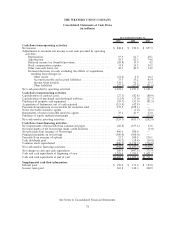

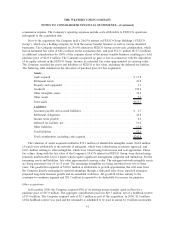

Settlement assets and obligations consisted of the following (in millions):

2009 2008

December 31,

Settlement assets:

Cash and cash equivalents .......................................... $ 161.9 $ 42.3

Receivables from selling agents and business-to-business customers ............ 1,004.4 759.6

Investment securities .............................................. 1,222.8 405.6

$2,389.1 $1,207.5

Settlement obligations:

Money transfer, money order and payment service payables .................. $1,954.8 $ 799.5

Payables to agents ................................................ 434.3 408.0

$2,389.1 $1,207.5

Property and Equipment

Property and equipment are stated at cost. Depreciation is computed using the straight-line method over

the lesser of the estimated life of the related assets (generally three to 10 years for equipment, furniture and

fixtures, and 30 years for buildings) or the lease term. Maintenance and repairs, which do not extend the

useful life of the respective assets, are charged to expense as incurred.

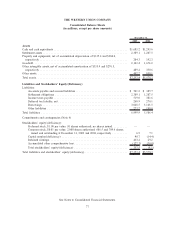

Property and equipment consisted of the following (in millions):

2009 2008

December 31,

Equipment ........................................................... $368.5 $ 319.2

Leasehold improvements ................................................. 50.0 38.9

Furniture and fixtures ................................................... 28.1 25.2

Land and improvements ................................................. 16.9 16.9

Buildings ............................................................ 75.2 74.8

Projects in process ..................................................... 1.0 1.3

539.7 476.3

Less accumulated depreciation ............................................ (335.4) (284.0)

Property and equipment, net .............................................. $204.3 $ 192.3

Amounts charged to expense for depreciation of property and equipment were $55.9 million,

$61.7 million and $49.1 million during the years ended December 31, 2009, 2008 and 2007, respectively.

84

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)