Western Union 2009 Annual Report Download - page 131

Download and view the complete annual report

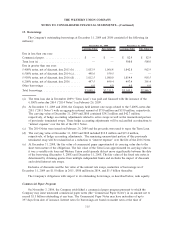

Please find page 131 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest with respect to the 2011 Notes and 2036 Notes is payable semiannually on May 17 and

November 17 each year based on fixed per annum interest rates of 5.400% and 6.200%, respectively. The

indenture governing the 2011 Notes and 2036 Notes contains covenants that, among other things, limit or

restrict the ability of the Company and other significant subsidiaries to grant certain types of security interests,

incur debt (in the case of significant subsidiaries), or enter into sale and leaseback transactions. The Company

may redeem the 2011 Notes and the 2036 Notes at any time prior to maturity at the greater of par or a price

based on the applicable treasury rate plus 15 basis points and 25 basis points, respectively.

On September 29, 2006, the Company issued $1.0 billion aggregate principal amount of unsecured notes

maturing on October 1, 2016. Interest on the 2016 Notes is payable semiannually on April 1 and October 1

each year based on a fixed per annum interest rate of 5.930%. The indenture governing the 2016 Notes

contains covenants that, among other things, limit or restrict the ability of the Company and other significant

subsidiaries to grant certain types of security interests, incur debt (in the case of significant subsidiaries) or

enter into sale and leaseback transactions. The Company may redeem the 2016 Notes at any time prior to

maturity at the greater of par or a price based on the applicable treasury rate plus 20 basis points.

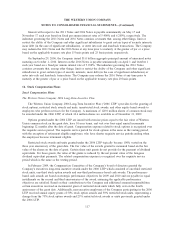

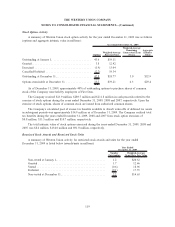

16. Stock Compensation Plans

Stock Compensation Plans

The Western Union Company 2006 Long-Term Incentive Plan

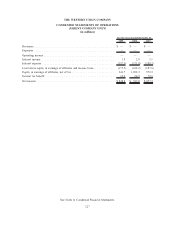

The Western Union Company 2006 Long-Term Incentive Plan (“2006 LTIP”) provides for the granting of

stock options, restricted stock awards and units, unrestricted stock awards, and other equity-based awards to

employees who perform services for the Company. A maximum of 120.0 million shares of common stock may

be awarded under the 2006 LTIP, of which 34.6 million shares are available as of December 31, 2009.

Options granted under the 2006 LTIP are issued with exercise prices equal to the fair value of Western

Union common stock on the grant date, have 10-year terms, and vest over four equal annual increments

beginning 12 months after the date of grant. Compensation expense related to stock options is recognized over

the requisite service period. The requisite service period for stock options is the same as the vesting period,

with the exception of retirement eligible employees, who have shorter requisite service periods ending when

the employees become retirement eligible.

Restricted stock awards and units granted under the 2006 LTIP typically become 100% vested on the

three year anniversary of the grant date. The fair value of the awards granted is measured based on the fair

value of the shares on the date of grant. Certain share unit grants do not provide for the payment of dividend

equivalents. For those grants, the value of the grants is reduced by the net present value of the foregone

dividend equivalent payments. The related compensation expense is recognized over the requisite service

period which is the same as the vesting period.

In February 2009, the Compensation Committee of the Company’s board of directors granted the

Company’s executives long-term incentive awards under the 2006 LTIP which consisted of one-third restricted

stock units, one-third stock option awards and one-third performance-based cash awards. The performance-

based cash awards are based on strategic performance objectives for 2009 and 2010 and are payable in equal

installments on the second and third anniversaries of the award, assuming the applicable performance

objectives are satisfied. Based on their contributions to the Company and additional assumed responsibilities,

certain executives received an incremental grant of restricted stock units which fully vest on the fourth

anniversary of the grant date. Additionally, non-executive employees of the Company participating in the 2006

LTIP received annual equity grants of 50% stock option awards and 50% restricted stock units, representing a

change from the 75% stock option awards and 25% restricted stock awards or units previously granted under

the 2006 LTIP.

117

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)