Western Union 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

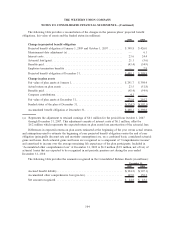

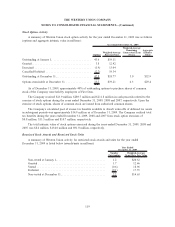

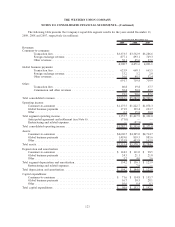

The following table summarizes the fair value of derivatives held at December 31, 2009 and their

expected maturities (in millions):

Total 2010 2011 Thereafter

Foreign currency cash flow

hedges—Consumer-to-consumer .................... $(15.9) $ (8.4) $ (7.5) $—

Foreign currency undesignated

hedges—Consumer-to-consumer .................... 3.5 3.5 — —

Foreign currency undesignated hedges—Global business

payments ..................................... 10.7 10.9 (0.2) —

Interest rate fair value hedges—Corporate ............... 31.0 20.5 10.5 —

Total .......................................... $29.3 $26.5 $ 2.8 $—

Income Statement

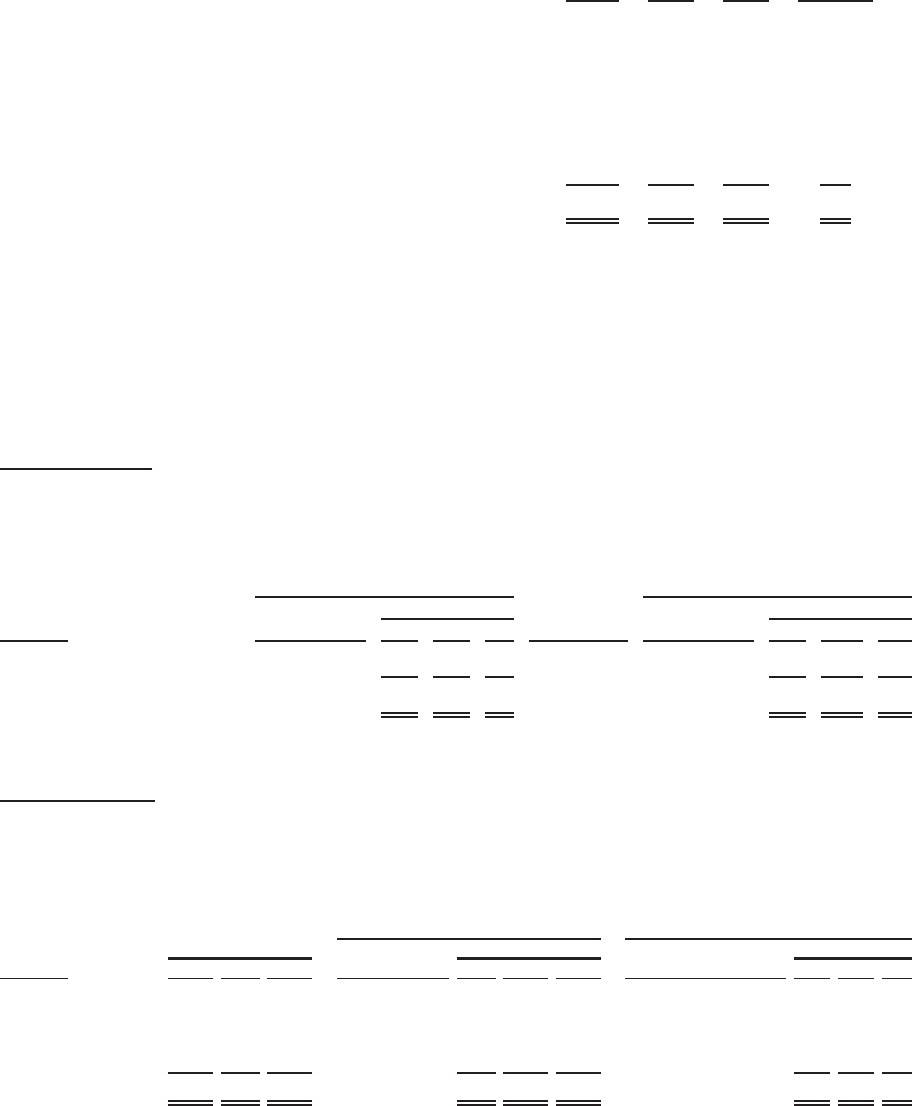

The following tables summarize the location and amount of gains and losses of derivatives in the

Consolidated Statements of Income segregated by designated, qualifying hedging instruments and those that

are not, for the years ended December 31, 2009, 2008 and 2007 (in millions):

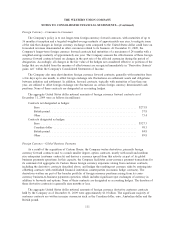

Fair Value Hedges

The following table presents the location and amount of gains/(losses) from fair value hedges for the

years ended December 31, 2009, 2008 and 2007 (in millions):

Derivatives

Income Statement

Location 2009 2008 2007 Hedged Items

Income Statement

Location 2009 2008 2007

Amount Amount

Gain Recognized in Income on Derivatives

Gain/(Loss) Recognized in Income on Related

Hedged Item (b)

Interest rate contracts .......... Interest expense $12.9 $58.5 $3.6 Fixed-rate debt Interest expense $11.1 $(54.6) $(3.6)

Total gain/(loss) . . . .......... $12.9 $58.5 $3.6 $11.1 $(54.6) $(3.6)

Cash Flow Hedges

The following table presents the location and amount of gains/(losses) from cash value hedges for the

years ended December 31, 2009, 2008 and 2007 (in millions):

Derivatives 2009 2008 2007

Income Statement

Location 2009 2008 2007

Income Statement

Location 2009 2008 2007

Amount of (Loss)/Gain

Recognized in OCI on

Derivatives (Effective

Portion) Amount Amount

Gain/(Loss) Reclassified from

Accumulated OCI into Income (Effective

Portion)

(Loss)/Gain Recognized in Income on

Derivative (Ineffective Portion and Amount

Excluded from Effectiveness Testing) (c)

Foreign currency

contracts . . . . . . . . $(43.6) $82.6 $(55.9) Revenue $34.6 $(23.4) $(29.6)

Derivative

(losses)/gains, net $(1.2) $(9.9) $8.7

Interest rate contracts

(d) . . . . . . . . . . . . — — — Interest expense (1.7) (1.7) (1.7)

Derivative

(losses)/gains, net — — —

Total gain/(loss) . . . . . $(43.6) $82.6 $(55.9) $32.9 $(25.1) $(31.3) $(1.2) $(9.9) $8.7

113

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)