Western Union 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

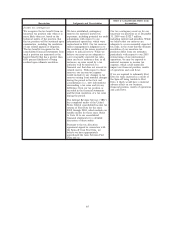

Description Judgments and Uncertainties

Effect if Actual Results Differ from

Assumptions

Other Intangible Assets

We capitalize certain initial payments

for new and renewed agent contracts

as well as acquired intangible assets

and software.

We evaluate such intangible assets for

impairment whenever events or

changes in circumstances indicate the

carrying value of such assets may not

be recoverable. In such reviews,

estimated undiscounted cash flows

associated with these assets are

compared with their carrying amounts

to determine if a write-down to fair

value (normally measured by

discounted cash flows) is required.

The capitalization of initial payments

for new and renewed agent contracts is

subject to strict accounting policy

criteria and requires management

judgment as to the appropriate time to

initiate capitalization. Our accounting

policy is to limit the amount of

capitalized costs for a given agent

contract to the lesser of the estimated

future cash flows from the contract or

the termination fees we would receive

in the event of early termination of the

contract.

The estimated undiscounted cash flows

associated with each asset requires us

to make estimates and assumptions

including among other things revenue

growth rates, and operating margins

based on our budgets and business

plans.

Disruptions to contractual

relationships, significant declines in

cash flows or transaction volumes

associated with contracts, or other

issues significantly impacting the

future cash flows associated with the

contract would cause us to evaluate the

recoverability of the asset.

If an event described above occurs and

causes us to determine that an asset

has been impaired, that could result in

an impairment charge. We did not

record any impairment charges related

to other intangible assets during the

three year period ended December 31,

2009.

The net carrying value of our other

intangible assets at December 31, 2009

was $489.2 million.

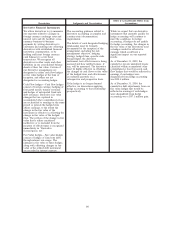

Goodwill Impairment Testing

We evaluate goodwill for impairment

annually and whenever events or

changes in circumstances indicate the

carrying value of the goodwill may not

be recoverable.

Goodwill impairment is determined

using a two-step process. The first step

is to identify if a potential impairment

exists by comparing the fair value of

each reporting unit to its carrying

amount. If the fair value of a reporting

unit exceeds its carrying amount,

goodwill of that reporting unit is not

considered to have a potential

impairment and the second step of the

impairment test is not necessary.

However, if the carrying amount of a

reporting unit exceeds its fair value,

the second step is performed to

determine the implied fair value of a

reporting unit’s goodwill, by

comparing the reporting unit’s fair

value to the allocated fair values of all

assets and liabilities, including any

unrecognized intangible assets, as if

the reporting unit had been acquired in

a business combination. If the carrying

amount of goodwill exceeds its

implied fair value, an impairment is

recognized in an amount equal to that

excess.

Reporting units are defined as an

operating segment or one level below

an operating segment.

We calculate the fair value of each

reporting unit through discounted cash

flow analyses which require us to

make estimates and assumptions

including, among other items, revenue

growth rates, operating margins, and

capital expenditures based on our

budgets and business plans which take

into account expected regulatory,

marketplace and other economic

factors.

The determination of the reporting

units also requires judgment.

We could be required to evaluate the

recoverability of goodwill prior to the

annual assessment if we experience

disruptions to the business, unexpected

significant declines in operating

results, a divestiture of a significant

component of our business, significant

declines in market capitalization or

other triggering events. In addition, as

our business or the way we manage

our business changes, our reporting

units may also change.

If an event described above occurs and

causes us to recognize a goodwill

impairment charge, it could impact our

reported earnings in the periods such

charge occurs.

The carrying value of goodwill as of

December 31, 2009 was $2,143.4

million which represented

approximately 29% of our

consolidated assets.

We have not recorded any goodwill

impairments during the three years

ended December 31, 2009.

The fair value of each of our reporting

units exceeded their carrying amounts

for the three years ended

December 31, 2009.

67