Western Union 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in December 2010 and 2011, subject to the terms of the agreement. The results of operations of the acquiree

have been included in the Company’s consolidated financial statements since the acquisition date. The

purchase price allocation resulted in $10.1 million of identifiable intangible assets, a significant portion of

which were attributable to the network of subagents acquired by the Company. The identifiable intangible

assets are being amortized over three to 10 years and goodwill of $27.1 million was recorded, most of which

is expected to be deductible for income tax purposes. In addition, the Company has the option to acquire the

remaining 20% of the money transfer agent and the money transfer agent has the option to sell the remaining

20% to the Company within 12 months after December 2013 at fair value.

In August 2008, the Company acquired the money transfer assets from its then-existing money transfer

agent in Panama for a purchase price of $18.3 million. The consideration paid was $14.3 million, net of a

holdback reserve of $4.0 million. In 2009, $1.7 million of the holdback reserve was paid and the remainder is

scheduled to be paid in approximately equal installments in August 2010 and 2011, subject to the terms of the

agreement. The results of operations of the acquiree have been included in the Company’s consolidated

financial statements since the acquisition date. The purchase price allocation resulted in $5.6 million of

identifiable intangible assets, a significant portion of which were attributable to the network of subagents

acquired by the Company. The identifiable intangible assets are being amortized over three to seven years and

goodwill of $14.2 million was recorded, which is not expected to be deductible for income tax purposes.

In October 2007, the Company entered into agreements totaling $18.3 million to convert its non-

participating interest in an agent in Singapore to a fully participating 49% equity interest and to extend the

agent relationship at more favorable commission rates to Western Union. As a result, the Company earns a

pro-rata share of profits and has enhanced voting rights. The Company also has the right to add additional

agent relationships in Singapore. In addition, in October 2007, the Company completed an agreement to

acquire a 25% ownership interest in an agent in Jamaica and to extend the term of the agent relationship for

$29.0 million. The aggregate consideration paid resulted in $20.2 million of identifiable intangible assets for

these two investments, including capitalized contract costs, which are being amortized over seven to 10 years.

Western Union’s investments in these agents are accounted for under the equity method of accounting.

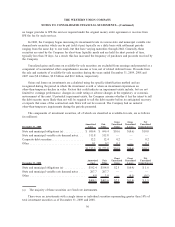

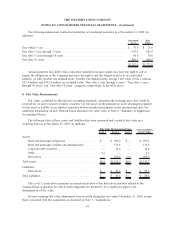

The following table presents changes to goodwill for the years ended December 31, 2009 and 2008 (in

millions):

Consumer-to-

Consumer

Global Business

Payments Other Total

January 1, 2008 balance . . ........................ $1,389.0 $235.9 $14.6 $1,639.5

Acquisitions ................................... 39.0 — — 39.0

Purchase price adjustments ........................ (1.0) — — (1.0)

Currency translation ............................. — (3.2) (0.1) (3.3)

December 31, 2008 balance ....................... $1,427.0 $232.7 $14.5 $1,674.2

Acquisitions ................................... 190.6 272.2 — 462.8

Purchase price adjustments ........................ 2.3 — — 2.3

Currency translation ............................. — 4.3 (0.2) 4.1

December 31, 2009 balance ....................... $1,619.9 $509.2 $14.3 $2,143.4

4. Restructuring and Related Expenses

Missouri and Texas Closures

During 2008, the Company closed substantially all of its facilities in Missouri and Texas and did not

renew the Company’s collective bargaining agreement with the unionized workers employed at these locations.

92

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)