Western Union 2009 Annual Report Download - page 59

Download and view the complete annual report

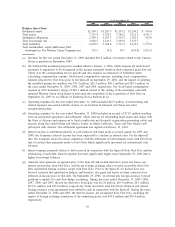

Please find page 59 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.employees received converted Western Union stock-based awards. All converted stock-based awards,

which had not vested prior to September 24, 2007, were subject to the terms and conditions

applicable to the original First Data stock-based awards, including change of control provisions

which require full vesting upon a change of control of First Data. Accordingly, upon the completion

of the acquisition of First Data on September 24, 2007 by an affiliate of KKR, all of these remaining

converted unvested Western Union stock-based awards vested. In connection with this accelerated

vesting, we incurred a non-cash pre-tax charge of $22.3 million during the third quarter of 2007.

Approximately one-third of this charge was recorded within “cost of services” and two-thirds was

recorded within “selling, general and administrative” expenses in the consolidated statements of

income.

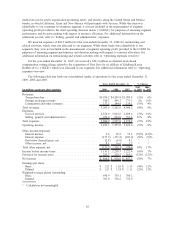

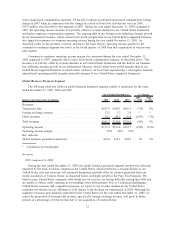

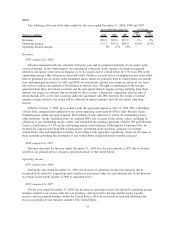

Cost of services

Cost of services decreased for the year ended December 31, 2009 compared to the corresponding period

in 2008 primarily due to agent commissions, which decreased due to revenue declines, as well as reduced

commissions resulting from the acquisition of FEXCO and other selective consumer-to-consumer commission

initiatives. Also impacting cost of services was the strengthening of the United States dollar for most of 2009

compared to most other foreign currencies, which resulted in a favorable impact on the translation of our

expenses, and restructuring costs incurred in 2008 which did not recur in 2009 and the related 2009 cost

savings. These costs were offset by incremental operating costs, including increased technology costs and costs

associated with Custom House. Cost of services as a percentage of revenue was 57% and 59% for the years

ended December 31, 2009 and 2008, respectively. The decrease in cost of services as a percentage of revenue

for the year ended December 31, 2009 compared to the corresponding period in 2008 was generally due to

reduced commissions resulting from the acquisition of FEXCO and selective consumer-to-consumer agent

commission initiatives, restructuring costs incurred in 2008 which did not recur in 2009 and the related 2009

cost savings, offset somewhat by incremental operating costs, including increased technology costs and costs

associated with Custom House.

In addition to the restructuring costs described above, cost of services increased for the year ended

December 31, 2008 compared to the corresponding period in 2007 primarily due to agent commissions which

increase as revenues increase. Cost of services as a percentage of revenue was 59% and 57% for the years

ended December 31, 2008 and 2007, respectively. The majority of the increase in cost of services as a

percentage of revenue for the year ended December 31, 2008 compared to the corresponding period in 2007

was primarily due to restructuring and related expenses of $62.8 million as described above, and the shift in

our business mix reflecting stronger growth from our international consumer-to-consumer business, which

carries higher cost of services compared to our United States originated businesses. Selected

consumer-to-consumer international agent commissions have been lowered but were partially offset by certain

higher commissions in the United States. In addition, a higher percentage of our global business payments

services were generated from our United States electronic-based payments and payments related to Pago Fácil,

each of which had higher cost of services as a percentage of revenue compared to our United States cash-

based payments business. The increase was partially offset by lower stock compensation charges for the year

ended December 31, 2008 compared to the corresponding period in 2007, as described above and below, that

did not recur in 2008.

Selling, general and administrative

SG&A increased for the year ended December 31, 2009 compared to the same period in the prior year

due to the settlement accrual described below, incremental costs associated with the acquisitions of FEXCO

and Custom House including costs related to evaluating and closing these acquisitions and other increased

operating expenses, offset by better leveraging of our marketing expenses, and restructuring costs incurred in

2008 which did not recur in 2009.

During the year ended December 31, 2009, we recorded an accrual of $71.0 million for an anticipated

agreement and settlement with the State of Arizona. On February 11, 2010, we signed this agreement and

settlement, which resolved all outstanding legal issues and claims with the State and requires us to fund a

45