Western Union 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

claims associated with the Fund, the Company reserved $12 million representing the estimated impact of a

pro-rata distribution of the Fund during 2009. As of December 31, 2009, the Company had a remaining

receivable balance of $30.6 million, net of the related reserve. If further deterioration occurs in the underlying

assets in the Fund, or if the Fund incurs significant legal and/or administrative costs during the distribution

process, the Company may record additional reserves related to the remaining receivable balance, which could

negatively affect its financial position, results of operations and cash flows.

Amounts advanced to agents, net of discounts

From time to time, the Company makes advances and loans to agents. In 2006, the Company signed a six

year agreement with one of its existing agents which included a four year loan of $140.0 million to the agent.

The remaining loan receivable balance at December 31, 2009 was $16.9 million, which was fully repaid in

January 2010. At December 31, 2008, the note had a receivable balance of $47.0 million, net of a discount of

$3.0 million, which represented imputed interest on this below-market rate note receivable. Other advances

and loans outstanding as of December 31, 2009 and 2008 were $20.6 million and $22.3 million, respectively.

10. Income Taxes

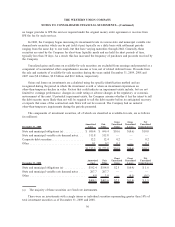

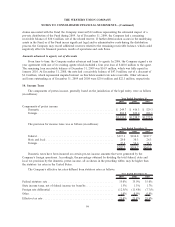

The components of pretax income, generally based on the jurisdiction of the legal entity, were as follows

(in millions):

2009 2008 2007

Year Ended December 31,

Components of pretax income:

Domestic ............................................... $ 249.7 $ 416.3 $ 529.3

Foreign................................................. 881.8 822.4 693.1

$1,131.5 $1,238.7 $1,222.4

The provision for income taxes was as follows (in millions):

2009 2008 2007

Year Ended December 31,

Federal ................................................. $217.3 $234.8 $287.7

State and local ........................................... 28.0 30.3 26.3

Foreign................................................. 37.4 54.6 51.1

$282.7 $319.7 $365.1

Domestic taxes have been incurred on certain pre-tax income amounts that were generated by the

Company’s foreign operations. Accordingly, the percentage obtained by dividing the total federal, state and

local tax provision by the domestic pretax income, all as shown in the preceding tables, may be higher than

the statutory tax rates in the United States.

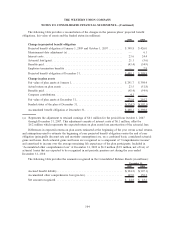

The Company’s effective tax rates differed from statutory rates as follows:

2009 2008 2007

Year Ended December 31,

Federal statutory rate .......................................... 35.0% 35.0% 35.0%

State income taxes, net of federal income tax benefits .................. 1.5% 1.3% 1.7%

Foreign rate differential ........................................ (12.5)% (11.4)% (7.7)%

Other ...................................................... 1.0% 0.9% 0.9%

Effective tax rate ............................................. 25.0% 25.8% 29.9%

99

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)