Western Union 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In May 2007, the Company initiated litigation against MoneyGram Payment Systems, Inc.

(“MoneyGram”) for infringement of the Company’s Money Transfer by Phone patents by MoneyGram’s

FormFree service. On September 24, 2009, a jury found that MoneyGram was liable for patent infringement

and awarded the Company $16.5 million in damages. This case is on appeal to the United States Court of

Appeals for the Federal Circuit. In accordance with its policies, the Company does not recognize gain

contingencies in earnings until realization and collectability are assured and, therefore, due to MoneyGram’s

challenges to the verdict, the Company has not recognized any amounts in its Consolidated Statement of

Income through December 31, 2009.

Pursuant to the separation and distribution agreement with First Data in connection with the Spin-off,

First Data and the Company are each liable for, and agreed to perform, all liabilities with respect to their

respective businesses. In addition, the separation and distribution agreement also provides for cross-

indemnities principally designed to place financial responsibility for the obligations and liabilities of the

Company’s business with the Company and financial responsibility for the obligations and liabilities of First

Data’s retained businesses with First Data. The Company also entered into a tax allocation agreement that sets

forth the rights and obligations of First Data and the Company with respect to taxes imposed on their

respective businesses both prior to and after the Spin-off as well as potential tax obligations for which the

Company may be liable in conjunction with the Spin-off (see Note 10).

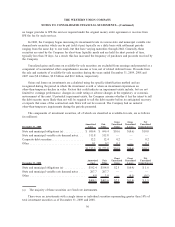

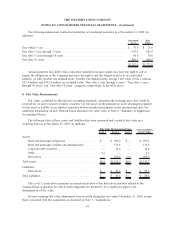

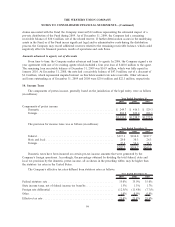

7. Investment Securities

Investment securities, classified within “Settlement assets” in the Consolidated Balance Sheets, consist

primarily of high-quality state and municipal debt obligations. Substantially all of the Company’s investment

securities were marketable securities during the periods presented. The Company is required to maintain specific

high-quality, investment grade securities and such investments are restricted to satisfy outstanding settlement

obligations in accordance with applicable state and foreign country requirements. Western Union does not hold

investment securities for trading purposes. All investment securities are classified as available-for-sale and

recorded at fair value. Investment securities are exposed to market risk due to changes in interest rates and credit

risk. Western Union regularly monitors credit risk and attempts to mitigate its exposure by making high-quality

investments and through investment diversification. At December 31, 2009, the majority of the Company’s

investment securities had credit ratings of “AA-” or better from a major credit rating agency.

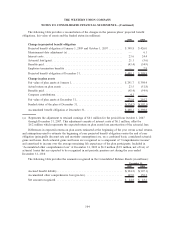

Effective October 1, 2009 (the “Transition Date”), in accordance with the agreement signed on July 18,

2008, IPS, a subsidiary of First Data, assigned and transferred to the Company certain operating assets used by

IPS to issue Western Union branded money orders and approximately $860 million of cash sufficient to satisfy

all outstanding money order liabilities. On the Transition Date, the Company assumed IPS’s role as issuer of

the money orders, including its obligation to pay outstanding money orders, and terminated the existing

agreement whereby IPS paid Western Union a fixed return of 5.5% on the outstanding money order balances.

Following the Transition Date, Western Union invested the cash received from IPS in high-quality, investment

grade securities, primarily tax exempt United States state and municipal securities, in accordance with

applicable regulations, which are the same as those currently governing the investment of the Company’s

United States originated money transfer principal. Prior to the Transition Date, the Company had entered into

interest rate swaps on certain of its fixed rate notes to reduce its exposure to fluctuations in interest rates.

Through a combination of the revenue generated from these investment securities and the anticipated interest

expense savings resulting from the interest rate swaps, the Company estimates that it should be able to retain,

subsequent to the Transition Date, a materially comparable after-tax rate of return through 2011 as it was

receiving under its agreement with IPS. Refer to Note 14 for additional information on the interest rate swaps.

Subsequent to the Transition Date, all revenue generated from the investment portfolio is being retained

by the Company. IPS continues to provide the Company with clearing services necessary for payment of the

money orders in exchange for the payment by the Company to IPS of a per-item processing fee. The Company

95

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)