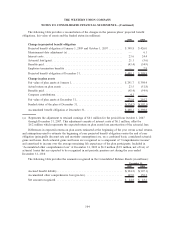

Western Union 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

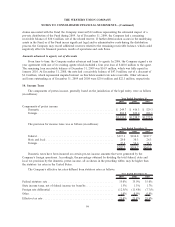

Other Fair Value Measurements

The carrying amounts for Western Union financial instruments, including cash and cash equivalents,

settlement cash and cash equivalents, settlement receivables and settlement obligations approximate fair value

due to their short maturities. The Company’s borrowings had a carrying value and fair value of

$3,048.5 million and $3,211.3 million, respectively, at December 31, 2009 and had a carrying value and fair

value of $3,143.5 million and $2,846.7 million, respectively, at December 31, 2008 (see Note 15).

The fair value of the assets in the Trust, which holds the assets for the Company’s defined benefit plans,

are disclosed in Note 11, “Employee Benefit Plans.”

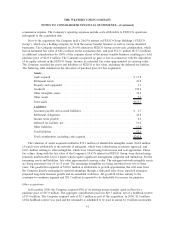

9. Other Assets and Other Liabilities

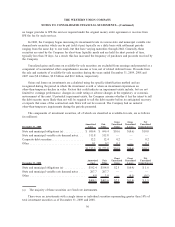

The following table summarizes the components of other assets and other liabilities (in millions):

2009 2008

December 31,

Other assets:

Derivatives ........................................................ $109.9 $116.8

Equity method investments............................................. 87.4 213.1

Other receivables .................................................... 63.4 33.2

Amounts advanced to agents, net of discounts............................... 37.5 69.3

Receivable for securities sold ........................................... 30.6 298.1

Deferred customer set up costs .......................................... 26.1 34.6

Receivables from First Data ............................................ 24.8 26.3

Prepaid expenses .................................................... 21.7 23.6

Debt issue costs ..................................................... 12.3 14.0

Accounts receivable, net............................................... 12.1 19.8

Other............................................................. 16.4 9.3

Total other assets ....................................................... $442.2 $858.1

Other liabilities:

Pension obligations .................................................. $124.2 $107.1

Derivatives ........................................................ 80.6 10.8

Deferred revenue .................................................... 45.4 59.4

Other............................................................. 23.0 20.7

Total other liabilities ..................................................... $273.2 $198.0

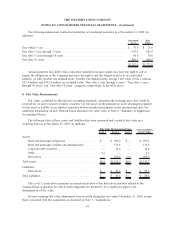

Receivable for securities sold

On September 15, 2008, Western Union requested redemption of its shares in the Reserve International

Liquidity Fund, Ltd. (the “Fund”), a money market fund, totaling $298.1 million. Western Union included the

value of the receivable in “Other assets” in the Consolidated Balance Sheets. At the time the redemption

request was made, the Company was informed by the Reserve Management Company, the Fund’s investment

advisor (the “Manager”), that the Company’s redemption trades would be honored at a $1.00 per share net

asset value. In 2009, the Company received partial distributions totaling $255.5 million from the Fund. The

Company continues to vigorously pursue collection of the remaining balance and believes it has a right to full

payment of the remaining amount based on the written and verbal representations from the Manager and the

Company’s legal position. However, given the increased uncertainty surrounding the numerous third-party legal

98

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)