Western Union 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.representations or covenants set forth in the tax allocation agreement. If the Company is required to indemnify

First Data for taxes incurred as a result of the Spin-off being taxable to First Data, it likely would have a

material adverse effect on the Company’s business, financial position and results of operations. First Data

generally will be liable for all Spin-off Related Taxes, other than those described above.

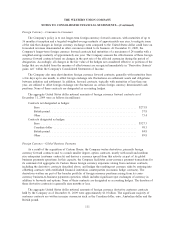

11. Employee Benefit Plans

Defined Contribution Plans

The Western Union Company Incentive Savings Plan (“401(k)”) covers eligible employees on the United

States payroll of Western Union. Employees who make voluntary contributions to this plan receive up to a 4%

Western Union matching contribution. All matching contributions are immediately 100% vested.

On September 30, 2009, the Company merged its defined contribution plan covering its former union

employees and transferred the plan assets into the 401(k).

The Company administers more than 20 defined contribution plans in various countries globally on behalf

of approximately 1,000 employee participants as of December 31, 2009. Such plans have vesting and employer

contribution provisions that vary by country.

In addition, Western Union sponsors a non-qualified deferred compensation plan for a select group of

highly compensated employees. The plan provides tax-deferred contributions, matching and the restoration of

Company matching contributions otherwise limited under the 401(k).

The aggregate amount charged to expense in connection with all of the above plans was $11.2 million,

$12.5 million and $11.6 million during the years ended December 31, 2009, 2008 and 2007, respectively.

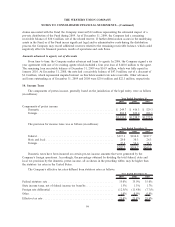

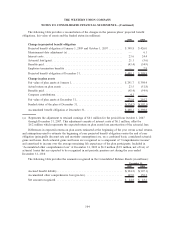

Defined Benefit Plans

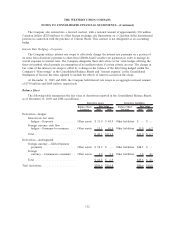

The Company has two frozen defined benefit pension plans (“Plans”) for which it had a recorded

unfunded pension obligation of $124.2 million as of December 31, 2009, included in “Other liabilities” in the

Consolidated Balance Sheets. Due to the closure of one of its facilities in Missouri (see Note 4) and a recent

agreement with the Pension Benefit Guaranty Corporation, the Company funded $4.1 million into one of its

subsidiary’s pension plans during 2009. No contributions were made to these plans by Western Union during

the years ended December 31, 2008 and 2007. Pursuant to final guidance issued by the IRS in September

2009, the Company made certain interest rate elections under the Pension Protection Act which will require it

to fund approximately $15 million to the plans in 2010, which is less than was previously anticipated. In

addition, the Company may make a discretionary contribution of up to approximately $10 million for a total

contribution of $25 million to the plans in 2010.

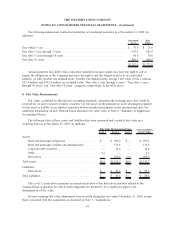

In connection with the adoption of an accounting standard, effective January 1, 2008, the Company

changed its plan measurement date to December 31. In connection with the Company’s change in

measurement date, the Company prepared a 15-month projection of net periodic benefit income for the period

from October 1, 2007 through December 31, 2008. The pro-rated portion of net periodic benefit income of

$0.1 million for the period from October 1, 2007 through December 31, 2007 was reflected as an increase to

“Retained earnings” on January 1, 2008.

The Company recognizes the funded status of its pension plans in its Consolidated Balance Sheets with a

corresponding adjustment to “Accumulated other comprehensive loss,” net of tax.

103

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)