Western Union 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PA RT I I

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

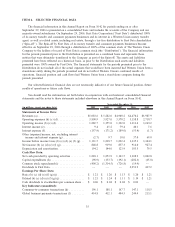

Our common stock trades on the New York Stock Exchange under the symbol “WU.” There were 4,643

stockholders of record as of February 12, 2010. This figure does not include an estimate of the indeterminate

number of beneficial holders whose shares may be held of record by brokerage firms and clearing agencies.

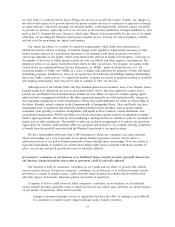

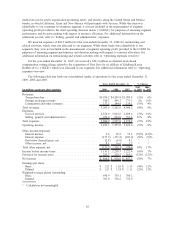

The following table presents the high and low prices of the common stock on the New York Stock Exchange

as well as dividends declared per share during the calendar quarter indicated.

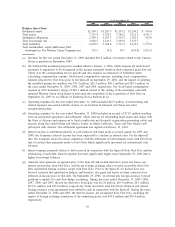

High Low

Dividends

Declared

per Share

Common Stock

Market Price

2009

First Quarter .................................................. $15.99 $10.05 $ —

Second Quarter ................................................ 18.37 12.08 —

Third Quarter ................................................. 20.64 15.11 —

Fourth Quarter ................................................ 20.09 17.81 0.06

2008

First Quarter .................................................. $24.31 $18.56 $ —

Second Quarter ................................................ 26.15 19.86 —

Third Quarter ................................................. 28.62 22.90 —

Fourth Quarter ................................................ 24.64 10.48 0.04

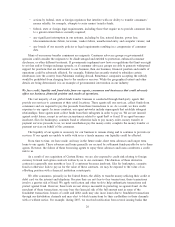

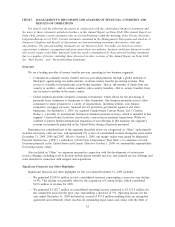

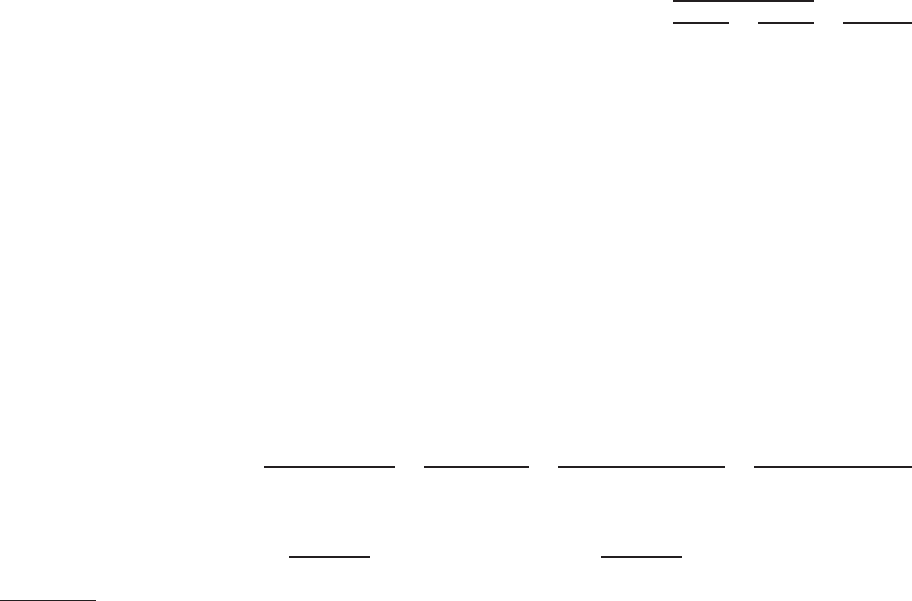

The following table sets forth stock repurchases for each of the three months of the quarter ended

December 31, 2009:

Total Number of

Shares Purchased*

Average Price

Paid per Share

Total Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs**

Remaining Dollar

Value of Shares that

May Yet Be Purchased

Under the Plans or

Programs (in millions)

October 1 – 31 ........... 3,209,047 $18.95 3,207,700 $ 653.9

November 1 – 30 ......... 5,487,699 $19.13 5,487,699 $ 548.9

December 1 – 31.......... 499,204 $18.42 499,204 $1,000.0

Total .................. 9,195,950 $19.03 9,194,603

* These amounts represent both shares authorized by the Board of Directors for repurchase under a

publicly announced plan, as described below, as well as shares withheld from employees to cover tax

withholding obligations on restricted stock awards and units that have vested.

** At December 31, 2009, common stock repurchases of up to $1.0 billion have been authorized by the

Board of Directors through December 31, 2012. Management has and may continue to establish

prearranged written plans pursuant to Rule 10b5-1. A Rule 10b5-1 plan permits us to repurchase shares

at times when we may otherwise be unable to do so, provided the plan is adopted when we are not aware

of material non-public information.

Refer to Note 16 of our Consolidated Financial Statements for information related to our equity

compensation plans.

33