Western Union 2009 Annual Report Download - page 68

Download and view the complete annual report

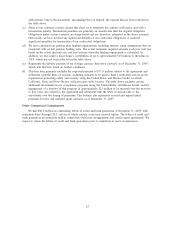

Please find page 68 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On September 1, 2009, we completed the acquisition of Canada-based Custom House, a provider of

international business-to-business payment services. Custom House facilitates cross-border, cross-currency

payment transactions. The significant majority of Custom House’s revenue is from exchanges of currency at

the spot rate enabling customers to make cross-currency payments. The credit risk arising from these spot

foreign currency exchange contracts is largely mitigated, as in the majority of cases Custom House requires

the receipt of funds from customers before releasing the associated cross-currency payment. In addition, this

business writes foreign currency forward and option contracts for their customers to facilitate future payments.

The duration of these derivatives contracts is generally nine months or less. The significant majority of

Custom House’s revenue is generated from transactions involving different currencies, in which Custom House

generates revenue based on the difference between the exchange rate set by Custom House to the customer

and the rate at which Custom House is able to acquire currency or forward and option contracts. This foreign

exchange revenue is recorded at the time the customer initiates a transaction with Custom House. The

acquisition of Custom House contributed $30.8 million to total revenue, primarily included in foreign

exchange revenue, and approximately 200,000 transactions for the year ended December 31, 2009.

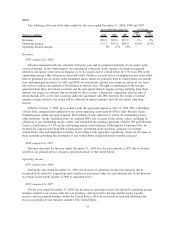

Transaction growth during the year ended December 31, 2009 compared to 2008 was driven by our Pago

Fácil cash-based and United States electronic-based bill payments businesses. Both of these businesses carry a

lower revenue per transaction than our United States cash-based bill payment business. The transaction growth

was offset by a decline in the United States cash-based bill payments business.

2008 compared to 2007

During the year ended December 31, 2008, overall revenue was flat compared to the corresponding

period in 2007, as revenue growth in the Pago Fácil business was offset by a decline in United States cash-

based bill payment revenue. The global business payments segment, including the United States electronic-

based bill payments business which experienced flat revenues year over year, was adversely impacted in the

last half of 2008 due to the weakening economy in the United States. Some consumers who were likely to use

our services were having difficulty paying their bills and were unable to obtain credit in any form, resulting in

us handling fewer bill payments.

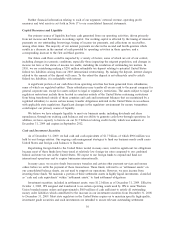

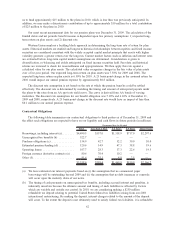

Operating income

2009 compared to 2008

For the year ended December 31, 2009, operating income decreased compared to the same period in the

prior year primarily due to operating income declines related to the United States-based bill payments business

and operating and integration costs associated with the acquisition of Custom House, offset slightly by the

savings generated from the 2008 restructurings.

The decline in operating income margin in the segment is due to the factors described above and

continues to be impacted by the decline in the United States cash-based bill payments business which has a

higher operating income margin than our South America and electronic businesses.

2008 compared to 2007

Operating income for the global business payments segment decreased for the year ended December 31,

2008 compared to 2007 primarily due to operating income declines in the United States-based bill payments

businesses, partially offset by growth in Pago Fácil payments. Operating income margins also declined as

United States electronic-based and Pago Fácil payments, which cumulatively represented a higher percentage

of global business payments revenues in 2008 compared to 2007, have lower operating margins than the

declining higher margin United States cash-based bill payments business. Partially offsetting operating income

declines for the year ended December 31, 2008 compared to 2007 was lower stock-based compensation

expenses as described in the “consumer-to-consumer” operating income discussion.

54