Western Union 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

financial cost that does not exceed its related reserve. With respect to these reserves, the Company’s income

tax expense would include (i) any changes in tax reserves arising from material changes during the period in

the facts and circumstances (i.e., new information) surrounding a tax issue and (ii) any difference from the

Company’s tax position as recorded in the financial statements and the final resolution of a tax issue during

the period.

The Company adopted an accounting standard relating to the accounting for and disclosure of uncertain

tax positions on January 1, 2007. The cumulative effect of applying this standard resulted in a reduction of

$0.6 million to the January 1, 2007 balance of retained earnings.

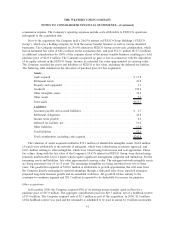

Unrecognized tax benefits represent the aggregate tax effect of differences between tax return positions

and the amounts otherwise recognized in the Company’s financial statements, and are reflected in “Income

taxes payable” in the Consolidated Balance Sheets. A reconciliation of the beginning and ending amount of

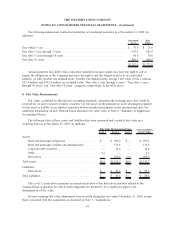

unrecognized tax benefits, excluding interest and penalties, is as follows (in millions):

2009 2008

Balance at January 1, ...................................... $361.2 $251.4

Increases—positions taken in current period (a) .................. 124.3 93.8

Increases—positions taken in prior periods (b) ................... 0.4 28.4

Decreases—positions taken in prior periods ..................... — (7.9)

Decreases—settlements with taxing authorities ................... (4.4) (0.2)

Decreases—lapse of applicable statute of limitations ............... (4.3) (4.3)

Balance at December 31, ................................... $477.2 $361.2

(a) Includes recurring accruals for issues which initially arose in previous periods.

(b) Changes to positions taken in prior periods relate to changes in estimates used to calculate prior period

unrecognized tax benefits.

A substantial portion of the Company’s unrecognized tax benefits relate to the 2003 restructuring of the

Company’s international operations whereby the Company’s income from certain foreign-to-foreign money

transfer transactions has been taxed at relatively low foreign tax rates compared to the Company’s combined

federal and state tax rates in the United States. The total amount of unrecognized tax benefits that, if

recognized, would affect the effective tax rate was $468.6 million and $352.4 million as of December 31, 2009

and 2008, respectively, excluding interest and penalties.

The Company recognizes interest and penalties with respect to unrecognized tax benefits in “Provision for

income taxes” in its Consolidated Statements of Income, and records the associated liability in “Income taxes

payable” in its Consolidated Balance Sheets. The Company recognized $11.0 million, $11.6 million and

$13.5 million in interest and penalties during the years ended December 31, 2009, 2008 and 2007,

respectively. The Company has accrued $45.5 million and $35.8 million for the payment of interest and

penalties at December 31, 2009 and 2008, respectively.

Subject to the matter referenced in the paragraph below, the Company has identified no other uncertain

tax positions for which it is reasonably possible that the total amount of unrecognized tax benefits will

significantly increase or decrease within 12 months, except for recurring accruals on existing uncertain tax

positions. The change in unrecognized tax benefits during the years ended December 31, 2009 and 2008 is

substantially attributable to such recurring accruals.

The Company and its subsidiaries file tax returns for the United States, for multiple states and localities,

and for various non-United States jurisdictions, and the Company has identified the United States and Ireland

as its two major tax jurisdictions. The United States federal income tax returns of First Data, which include

101

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)