Western Union 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company continues to benefit from an increasing proportion of profits being foreign-derived and

therefore taxed at lower rates than its combined federal and state tax rates in the United States. In addition, in

the second quarter of 2008, the Company implemented additional foreign tax efficient strategies consistent

with its overall tax planning which impacted its effective tax rate for all subsequent periods.

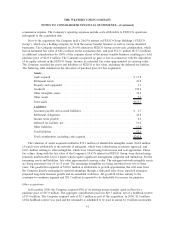

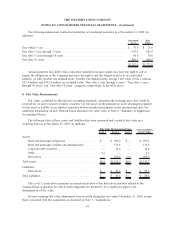

Western Union’s provision for income taxes consisted of the following components (in millions):

2009 2008 2007

Year Ended December 31,

Current:

Federal ................................................. $235.8 $219.6 $284.9

State and local ........................................... 26.0 34.5 25.5

Foreign................................................. 41.8 49.7 50.5

Total current taxes ............................................ 303.6 303.8 360.9

Deferred:

Federal ................................................. (18.5) 15.2 2.8

State and local ........................................... 2.0 (4.2) 0.8

Foreign................................................. (4.4) 4.9 0.6

Total deferred taxes ........................................... (20.9) 15.9 4.2

$282.7 $319.7 $365.1

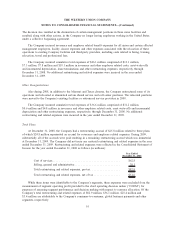

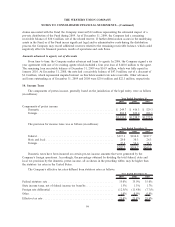

Deferred tax assets and liabilities are recognized for the expected tax consequences of temporary

differences between the book and tax bases of Western Union’s assets and liabilities. The following table

outlines the principal components of deferred tax items (in millions):

2009 2008

December 31,

Deferred tax assets related to:

Reserves, accrued expenses and employee-related items ....................... $ 91.0 $ 45.4

Pension obligations .................................................. 43.5 39.5

Deferred revenue .................................................... 3.6 3.1

Other............................................................. 10.7 6.8

Total deferred tax assets .................................................. 148.8 94.8

Deferred tax liabilities related to:

Intangibles, property and equipment ...................................... 416.7 349.0

Other............................................................. 1.0 15.9

Total deferred tax liabilities ................................................ 417.7 364.9

Net deferred tax liability .................................................. $268.9 $270.1

Uncertain Tax Positions

The Company has established contingency reserves for material, known tax exposures, including potential

tax audit adjustments with respect to its international operations, which were restructured in 2003. The

Company’s tax reserves reflect management’s judgment as to the resolution of the issues involved if subject to

judicial review. While the Company believes its reserves are adequate to cover reasonably expected tax risks,

there can be no assurance that, in all instances, an issue raised by a tax authority will be resolved at a

100

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)