Western Union 2009 Annual Report Download - page 57

Download and view the complete annual report

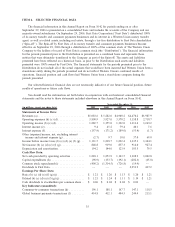

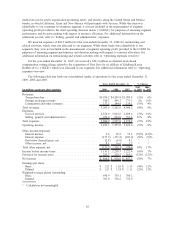

Please find page 57 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenues overview

2009 compared to 2008

The majority of transaction fees and foreign exchange revenue were contributed by our

consumer-to-consumer segment, which is discussed in greater detail in “Segment Discussion.” Consolidated

revenue declined 4% during the year ended December 31, 2009. The revenue decline was attributable to the

weak global economy and slowing transaction growth, and to a lesser extent, geographic mix, product mix

including a higher percentage of revenue earned from intra-country activity, which has lower revenue per

transaction than cross-border transactions, and price decreases. Also impacting the revenue decline was the

strengthening of the United States dollar compared to most other foreign currencies for the majority of the

year, which adversely impacted revenue by approximately 3%, as discussed below.

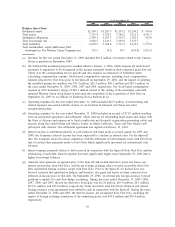

The Europe, Middle East, Africa and South Asia (“EMEASA”) region of our consumer-to-consumer

segment, which represented 45% of our total consolidated revenue for the year ended December 31, 2009,

experienced revenue declines and slower transaction growth rates during the year ended December 31, 2009

compared to the corresponding period in the prior year. The revenue declines were driven by most of the same

factors discussed above. The acquisition of FEXCO’s money transfer business did not have an impact on our

revenue as we were already recognizing 100% of the revenue arising from money transfers originating at

FEXCO’s locations.

The Americas region (including North America, Latin America, the Caribbean and South America) of our

consumer-to-consumer segment, which represented 32% of our total consolidated revenue for the year ended

December 31, 2009, experienced revenue and transaction declines due to the overall weak United States

economy. Our Americas results were further impacted by pricing reductions taken in the United States in the

fourth quarter of 2009 which improved our transaction volumes, but contributed to the decline in revenue.

The global business payments segment, which is discussed in greater detail in “Segment Discussion,” also

experienced revenue declines during the year ended December 31, 2009 compared to the corresponding prior

period. Revenue was adversely impacted by the weak economic situation in the United States, which resulted

in a revenue decline in our United States cash and electronic bill payments businesses. Offsetting these

declines in 2009 were the results of our Custom House acquisition, which contributed $30.8 million of revenue

for the year ended December 31, 2009.

Foreign exchange revenue increased for the year ended December 31, 2009 over 2008 primarily due to

foreign exchange revenue from Custom House. Excluding the impact of Custom House, foreign exchange

revenue decreased at a rate relatively consistent with the decrease in our revenue from our international

consumer-to-consumer business outside of the United States.

Fluctuations in the exchange rate between the United States dollar and currencies other than the

United States dollar have resulted in a reduction to transaction fee and foreign exchange revenue for the year

ended December 31, 2009 of $119.5 million over the previous year, net of foreign currency hedges, that would

not have occurred had there been constant currency rates. The impact to earnings per share during the period

was less than the revenue impact due to the translation of expenses and our foreign currency hedging program.

The majority of our foreign currency exchange rate exposure is related to the EMEASA region.

2008 compared to 2007

Consolidated revenue growth of 8% during the year ended December 31, 2008 was primarily driven by

revenue growth internationally, particularly in the EMEASA region, due to increased money transfers at

existing agent locations, and to a lesser extent, money transfers at new agent locations and due to the impact

of translating foreign currency denominated revenues into the United States dollar, specifically the euro,

discussed below. Our international consumer-to-consumer transactions that were originated outside of the

United States also continued to experience strong revenue and transaction growth for the year ended

December 31, 2008 compared to the corresponding period in the prior year.

43