Western Union 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.currency exchange rates increasing against the United States dollar during the year was offset by the impact of

foreign currency derivative losses for those foreign currency derivatives not designated as hedges and the

portion of fair value that is excluded from the measure of effectiveness for these contracts designated as

hedges thereby resulting in a minimal impact to overall earnings per share.

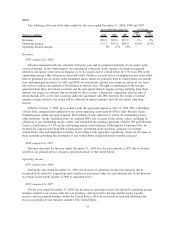

Americas revenue declined 1% for the year ended December 31, 2008 compared to the corresponding

period in 2007 but transactions grew 2% for the same period. The United States domestic and the

United States outbound revenue continued to decline, due to the overall weakening in the United States

economy and rising unemployment, for the year ended December 31, 2008. Within the Americas region,

revenue declines in our domestic business, which represents approximately 10% of consolidated revenue for

the year ended December 31, 2008, continued to occur due to the factors described above. Although the

domestic and United States outbound revenue declines experienced in 2008 moderated compared to those

experienced in 2007, we did experience increased revenue declines in the fourth quarter of 2008 compared to

the third quarter of 2008, due to the further weakening in the United States economy.

Domestic revenue declined 6% on transaction declines of 3% for the year ended December 31, 2008

compared to the corresponding period in 2007. In addition, United States telephone money transfer revenues

continued to decline, and website money transfer revenues were flat for the year ended December 31, 2008.

Revenue in our Mexico business was down 2% on transaction declines of 1% for the year ended

December 31, 2008 compared to the same period in 2007. The Mexico business continued to be impacted by

the weakening in the United States economy, noted earlier, with such declines increasing in the fourth quarter

of 2008. During a few weeks in the fourth quarter 2008, the value of the Mexican peso decreased dramatically

against the United States dollar and, as a result, we experienced a spike in transactions as United States

senders took advantage of the more favorable exchange rates. As the devaluation of the peso was sudden and

unusual, we needed to acquire pesos at less favorable rates in order to meet the demand for immediate payout

in Mexico, which impacted the overall decline in revenue by less than $5 million.

Revenue and transaction growth in the APAC region for the year ended December 31, 2008 compared to

the same period in 2007 was driven by strong inbound growth to the region, especially to the Philippines.

China revenue and transactions grew at 13% and 11% for the year ended December 31, 2008 compared to the

corresponding period in 2007, respectively. Revenue growth rates slowed to China during the third quarter of

2008, with revenue declining in the fourth quarter of 2008 compared to the same period in 2007, in part due

to the weakening economic situation described previously and the decline in high revenue transactions from

small entrepreneurs that typically make purchases in China.

Foreign exchange revenue increased for the year ended December 31, 2008 compared to the same period

in the prior year due to an increase in cross-currency transactions primarily as a result of growth in

international consumer-to-consumer transactions. As described above, foreign exchange revenue also benefited

during the year ended December 31, 2008 compared to 2007 from the exchange rate between other currencies

against the United States dollar, despite the negative impact of currency rate fluctuations in the fourth quarter

of 2008.

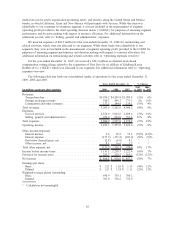

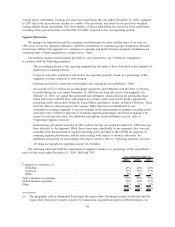

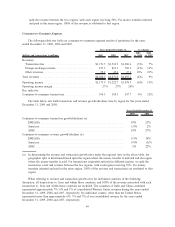

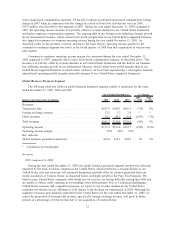

Operating income

2009 compared to 2008

Consumer-to-consumer operating income decreased 4% during the year ended December 31, 2009

compared to 2008 due to the decline in revenue, incremental costs, including increased technology costs and

the acquisition of FEXCO, offset somewhat by reduced agent commissions, savings realized from the 2008

restructurings and better leveraging of our marketing expenses, as described earlier. The operating income

margin for the year ended December 31, 2009 was consistent with 2008.

2008 compared to 2007

Consumer-to-consumer operating income increased for the year ended December 31, 2008 compared to

2007, primarily driven by higher revenue and related profits from increased transactions internationally and

52