Western Union 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

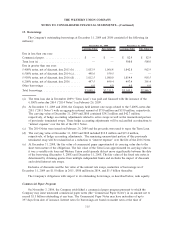

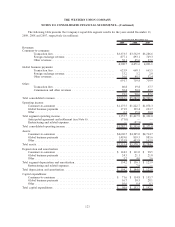

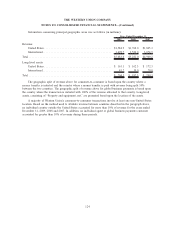

15. Borrowings

The Company’s outstanding borrowings at December 31, 2009 and 2008 consisted of the following (in

millions):

Carrying Value Fair Value (e) Carrying Value Fair Value (e)

December 31, 2009 December 31, 2008

Due in less than one year:

Commercial paper....................... $ — $ — $ 82.9 $ 82.9

Term loan (a) .......................... — — 500.0 500.0

Due in greater than one year:

5.400% notes, net of discount, due 2011 (b) . . . 1,033.9 1,066.4 1,042.8 962.9

6.500% notes, net of discount, due 2014 (c) .... 498.6 559.5 — —

5.930% notes, net of discount, due 2016 (d) . . . 1,012.5 1,080.0 1,014.4 903.5

6.200% notes, net of discount, due 2036 ...... 497.5 499.4 497.4 391.4

Other borrowings ....................... 6.0 6.0 6.0 6.0

Total borrowings ........................ $3,048.5 $3,211.3 $3,143.5 $2,846.7

(a) The term loan due in December 2009 (“Term Loan”) was paid and financed with the issuance of the

6.500% notes due 2014 (“2014 Notes”) on February 26, 2009.

(b) At December 31, 2009 and 2008, the Company held interest rate swaps related to the 5.400% notes due

2011 (“2011 Notes”) with an aggregate notional amount of $750 million and $550 million, respectively.

The carrying value at December 31, 2009 and 2008 contained $34.3 million and $42.7 million,

respectively, of hedge accounting adjustments related to active swaps as well as the unamortized portion

of previously terminated swaps. These hedge accounting adjustments will be reclassified as reductions to

“interest expense” over the life of the 2011 Notes.

(c) The 2014 Notes were issued on February 26, 2009 and the proceeds were used to repay the Term Loan.

(d) The carrying value at December 31, 2009 and 2008 included $12.8 million and $15.4 million,

respectively, of hedge accounting adjustments. The remaining unamortized portion of this previously

terminated swap will be reclassified as a reduction to “interest expense” over the life of the 2016 Notes.

(e) At December 31, 2008, the fair value of commercial paper approximated its carrying value due to the

short term nature of the obligations. The fair value of the Term Loan approximated its carrying value as

it was a variable rate loan and Western Union credit spreads did not move significantly between the date

of the borrowing (December 5, 2008) and December 31, 2008. The fair value of the fixed rate notes is

determined by obtaining quotes from multiple independent banks and excludes the impact of discounts

and related interest rate swaps.

Exclusive of discounts and the fair value of the interest rate swaps, maturities of borrowings as of

December 31, 2009 are $1.0 billion in 2011, $500 million in 2014, and $1.5 billion thereafter.

The Company’s obligations with respect to its outstanding borrowings, as described below, rank equally.

Commercial Paper Program

On November 3, 2006, the Company established a commercial paper program pursuant to which the

Company may issue unsecured commercial paper notes (the “Commercial Paper Notes”) in an amount not to

exceed $1.5 billion outstanding at any time. The Commercial Paper Notes may have maturities of up to

397 days from date of issuance. Interest rates for borrowings are based on market rates at the time of

115

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)