Western Union 2009 Annual Report Download - page 85

Download and view the complete annual report

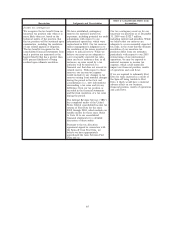

Please find page 85 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.representing the estimated impact of a pro-rata distribution of the Fund during 2009. As of December 31,

2009, we had a remaining receivable balance of $30.6 million, net of the related reserve, which is included in

“other assets” in the consolidated balance sheet. If further deterioration occurs in the underlying assets in the

Fund, or if the Fund incurs significant legal and/or administrative costs during the distribution process, we

may record additional reserves related to the remaining receivable balance, which could negatively affect our

financial position, results of operations and cash flows.

To manage our exposures to credit risk with respect to investment securities, money market investments

and other credit risk exposures resulting from our relationships with banks and financial institutions, we

regularly review investment concentrations, trading levels, credit spreads and credit ratings, and we attempt to

diversify our investments among global financial institutions. Since January 1, 2009, we also limit our

investment level to no more than $100 million with respect to individual funds.

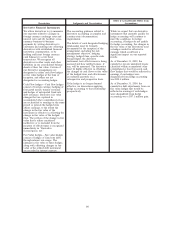

We are also exposed to credit risk related to receivable balances from agents in the money transfer, walk-

in bill payment and money order settlement process. In addition, we are exposed to credit risk directly from

consumer transactions particularly through our internet services and electronic channels, where transactions are

originated through means other than cash, and therefore are subject to “chargebacks,” insufficient funds or

other collection impediments, such as fraud. We perform a credit review before each agent signing and

conduct periodic analyses. Our losses associated with agent and consumer bad debts have been less than 1%

of our revenues in all periods presented. We continue to monitor the credit worthiness of our agents, and due

to the challenging economy, we have closed agents at higher rates than in prior years, primarily small retailers

in the United States. Closing agents may impact transactions and revenues.

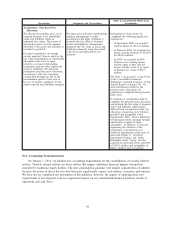

As a result of our acquisition of Custom House, we are now exposed to credit risk relating to derivative

financial instruments written by us to our customers. The duration of these derivative contracts is generally

nine months or less. To mitigate risk, we perform credit reviews of the customer on an ongoing basis. In

addition, we may require certain customers to post collateral based on the fair value of the customer’s contract

and their risk profile. The credit risk arising from our spot foreign currency exchange contracts is largely

mitigated, as in most cases we require the receipt of funds from our customers before releasing the associated

cross-currency payment.

71