Western Union 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

commission expense. The Company’s operating expenses include costs attributable to FEXCO’s operations

subsequent to the acquisition date.

Prior to the acquisition, the Company held a 24.65% interest in FEXCO Group Holdings (“FEXCO

Group”), which was a holding company for both the money transfer business as well as various unrelated

businesses. The Company surrendered its 24.65% interest in FEXCO Group as non-cash consideration, which

had an estimated fair value of $86.2 million on the acquisition date, and paid A123.1 million ($157.4 million)

as additional consideration for 100% of the common shares of the money transfer business, resulting in a total

purchase price of $243.6 million. The Company recognized no gain or loss in connection with the disposition

of its equity interest in the FEXCO Group, because its estimated fair value approximated its carrying value.

The Company recorded the assets and liabilities of FEXCO at fair value, excluding the deferred tax liability.

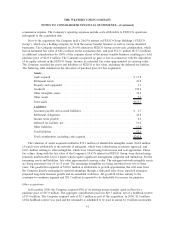

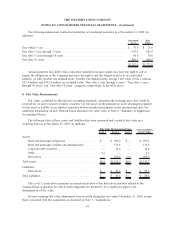

The following table summarizes the allocation of purchase price for this acquisition:

Assets:

Cash acquired ................................................... $ 11.8

Settlement assets ................................................. 43.0

Property and equipment ............................................ 3.1

Goodwill....................................................... 190.6

Other intangible assets ............................................. 74.9

Other assets..................................................... 2.3

Total assets ..................................................... $325.7

Liabilities:

Accounts payable and accrued liabilities................................ $ 2.7

Settlement obligations ............................................. 43.0

Income taxes payable.............................................. 0.2

Deferred tax liability, net ........................................... 19.2

Other liabilities .................................................. 17.0

Total liabilities .................................................. 82.1

Total consideration, including cash acquired ............................. $243.6

The valuation of assets acquired resulted in $74.9 million of identifiable intangible assets, $64.8 million

of which were attributable to the network of subagents, which were valued using an income approach, and

$10.1 million relating to other intangibles, which were valued using both income and cost approaches. These

fair values, along with the fair value of the Company’s 24.65% interest in FEXCO Group, were derived using

primarily unobservable Level 3 inputs which require significant management judgment and estimation. For the

remaining assets and liabilities, fair value approximated carrying value. The subagent network intangible assets

are being amortized over 10 to 15 years. The remaining intangibles are being amortized over two to three

years. The goodwill recognized of $190.6 million is attributable to growth opportunities that will arise from

the Company directly managing its agent relationships through a dedicated sales force, expected synergies,

projected long-term business growth and an assembled workforce. All goodwill relates entirely to the

consumer-to-consumer segment and $91.1 million is expected to be deductible for income tax purposes.

Other acquisitions

In December 2008, the Company acquired 80% of its existing money transfer agent in Peru for a

purchase price of $35.0 million. The aggregate consideration paid was $29.7 million, net of a holdback reserve

of $3.0 million. The Company acquired cash of $2.3 million as part of the acquisition. In 2009, $1.0 million

of the holdback reserve was paid and the remainder is scheduled to be paid in annual $1.0 million increments

91

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)