Western Union 2009 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

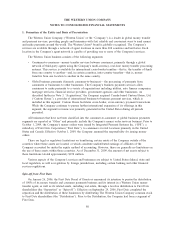

Basis of Presentation

The financial statements in this Annual Report on Form 10-K are presented on a consolidated basis and

include the accounts of the Company and its majority-owned subsidiaries. All significant intercompany

transactions and accounts have been eliminated.

Consistent with industry practice, the accompanying Consolidated Balance Sheets are unclassified due to

the short-term nature of Western Union’s settlement obligations contrasted with the Company’s ability to invest

cash awaiting settlement in long-term investment securities.

2. Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America (“GAAP”) requires management to make estimates and assumptions that affect the

amounts reported in the financial statements and accompanying notes. Actual results could differ from these

estimates.

Principles of Consolidation

Western Union consolidates financial results when it will absorb a majority of an entity’s expected losses

or residual returns or when it has the ability to exert control over the entity. Control is normally established

when ownership interests exceed 50% in an entity. Western Union utilizes the equity method of accounting

when it is able to exercise significant influence over the entity’s operations, which generally occurs when

Western Union has an ownership interest of between 20% and 50% in an entity.

Earnings Per Share

The calculation of basic earnings per share is computed by dividing net income available to common

stockholders by the weighted-average number of shares of common stock outstanding for the period. Unvested

shares of restricted stock are excluded from basic shares outstanding. Diluted earnings per share reflects the

potential dilution that could occur if outstanding stock options at the presented dates are exercised and shares

of restricted stock have vested, using the treasury stock method. The treasury stock method assumes proceeds

from the exercise price of stock options, the unamortized compensation expense and assumed tax benefits of

options and restricted stock are available to acquire shares at an average market price throughout the year, and

therefore, reduce the dilutive effect.

As of December 31, 2009, 2008 and 2007, there were 37.5 million, 8.0 million and 10.4 million,

respectively, of outstanding options to purchase shares of Western Union stock excluded from the diluted

earnings per share calculation, as their effect was anti-dilutive. During the year ended December 31, 2009, the

average market price of the Company’s common stock was lower than the exercise price for most of its

outstanding options, resulting in higher anti-dilutive shares than in the comparable prior periods.

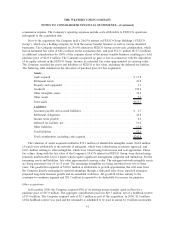

The following table provides the calculation of diluted weighted-average shares outstanding (in millions):

2009 2008 2007

For the Year Ended

December 31,

Basic weighted-average shares outstanding ................................ 698.9 730.1 760.2

Common stock equivalents ........................................... 2.1 8.1 12.7

Diluted weighted-average shares outstanding . . ............................ 701.0 738.2 772.9

81

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)