Western Union 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

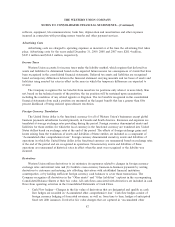

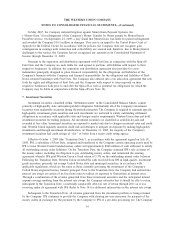

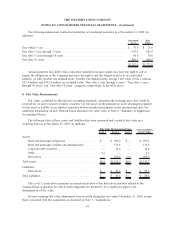

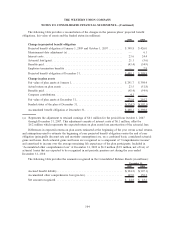

The following summarizes contractual maturities of investment securities as of December 31, 2009 (in

millions):

Amortized

Cost

Fair

Value

Due within 1 year .................................................... $ 76.5 $ 76.6

Due after 1 year through 5 years ......................................... 597.9 605.9

Due after 5 years through 10 years ....................................... 68.8 70.8

Due after 10 years.................................................... 469.3 469.5

$1,212.5 $1,222.8

Actual maturities may differ from contractual maturities because issuers may have the right to call or

prepay the obligations or the Company may have the right to put the obligation prior to its contractual

maturity, as with variable rate demand notes. Variable rate demand notes, having a fair value of $22.1 million,

$27.4 million and $452.4 million are included in the “Due after 1 year through 5 years,” “Due after 5 years

through 10 years” and “Due after 10 years” categories, respectively, in the table above.

8. Fair Value Measurements

Fair value, as defined by the relevant accounting standards, represents the exchange price that would be

received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market

for the asset or liability in an orderly transaction between market participants on the measurement date. For

additional information on how Western Union measures fair value, refer to Note 2, “Summary of Significant

Accounting Policies.”

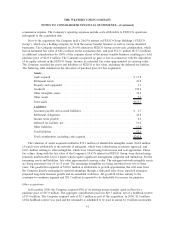

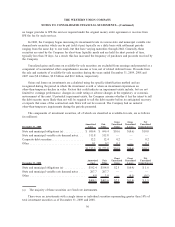

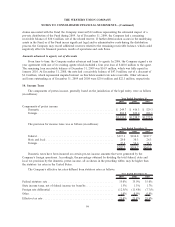

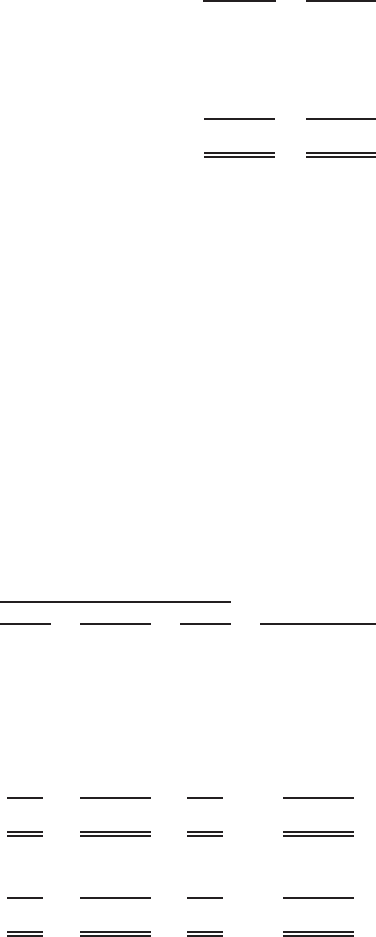

The following table reflects assets and liabilities that were measured and carried at fair value on a

recurring basis as of December 31, 2009 (in millions):

Level 1 Level 2 Level 3

Assets/Liabilities

at Fair Value

Fair Value Measurement Using

Assets:

State and municipal obligations .................... $— $ 696.4 $ — $ 696.4

State and municipal variable rate demand notes ........ — 513.8 — 513.8

Corporate debt securities ......................... — 12.4 — 12.4

Other ....................................... 0.2 — — 0.2

Derivatives ................................... — 109.4 0.5 109.9

Total assets ...................................... $0.2 $1,332.0 $0.5 $1,332.7

Liabilities:

Derivatives ................................... $— $ 80.6 $ — $ 80.6

Total liabilities .................................... $— $ 80.6 $ — $ 80.6

The Level 3 assets above represent an immaterial portion of the derivatives portfolio related to the

Custom House acquisition for which credit judgments are deemed to be a significant input to the

determination of fair value.

No non-recurring fair value adjustments were recorded during the year ended December 31, 2009, except

those associated with the acquisitions as disclosed in Note 3, “Acquisitions.”

97

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)