Western Union 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

us to fund approximately $15 million to the plans in 2010, which is less than was previously anticipated. In

addition, we may make a discretionary contribution of up to approximately $10 million for a total contribution

of $25 million to the plans in 2010.

Our most recent measurement date for our pension plans was December 31, 2009. The calculation of the

funded status and net periodic benefit income is dependent upon two primary assumptions: 1) expected long-

term return on plan assets; and 2) discount rate.

Western Union employs a building block approach in determining the long-term rate of return for plan

assets. Historical markets are studied and long-term historical relationships between equities and fixed income

securities are considered consistent with the widely accepted capital market principle that assets with higher

volatility generate a greater return over the long run. Current market factors such as inflation and interest rates

are evaluated before long-term capital market assumptions are determined. Consideration is given to

diversification, re-balancing and yields anticipated on fixed income securities held. Peer data and historical

returns are reviewed to check for reasonableness and appropriateness. We then apply this rate against a

calculated value for our plan assets. The calculated value recognizes changes in the fair value of plan assets

over a five-year period. Our expected long-term return on plan assets was 7.50% for 2009 and 2008. The

expected long-term return on plan assets is 6.50% for 2010. A 25 basis point change in the assumed return for

2010 would impact our annual pension expense by approximately $0.8 million.

The discount rate assumption is set based on the rate at which the pension benefits could be settled

effectively. The discount rate is determined by matching the timing and amount of anticipated payouts under

the plans to the rates from an AA spot rate yield curve. The curve is derived from AA bonds of varying

maturities. The discount rate assumption for our benefit obligation was 5.30% and 6.26% at December 31,

2009 and 2008, respectively. A 25 basis point change in the discount rate would have an impact of less than

$0.1 million to our annual pension expense.

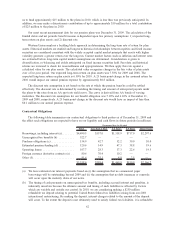

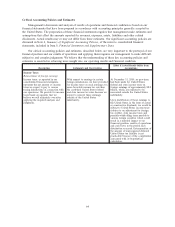

Contractual Obligations

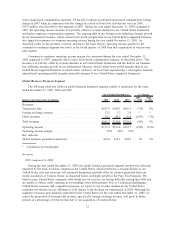

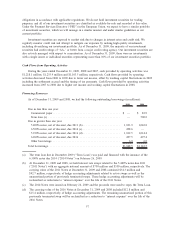

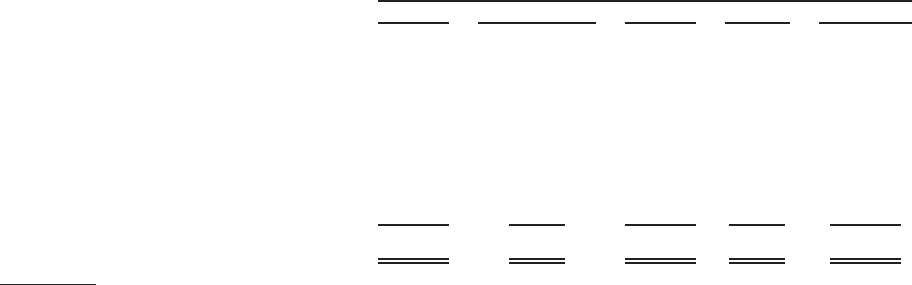

The following table summarizes our contractual obligations to third parties as of December 31, 2009 and

the effect such obligations are expected to have on our liquidity and cash flows in future periods (in millions):

Total Less than 1 Year 1-3 Years 3-5 Years After 5 Years

Payments Due by Period

Borrowings, including interest (a)........ $4,490.5 $157.0 $1,318.9 $717.0 $2,297.6

Unrecognized tax benefits (b) .......... 522.7 — — — —

Purchase obligations (c) ............... 154.9 42.7 52.2 30.0 30.0

Estimated pension funding (d) .......... 120.6 14.9 47.3 38.8 19.6

Operating leases .................... 107.7 28.3 37.3 22.6 19.5

Foreign currency derivative contracts (e) . . 80.6 70.4 10.2 — —

Other (f) .......................... 81.6 75.1 4.0 2.5 —

$5,558.6 $388.4 $1,469.9 $810.9 $2,366.7

(a) We have estimated our interest payments based on (i) the assumption that no commercial paper

borrowings will be outstanding beyond 2009 and (ii) the assumption that no debt issuances or renewals

will occur upon the maturity dates of our notes.

(b) The timing of cash payments on unrecognized tax benefits, including accrued interest and penalties, is

inherently uncertain because the ultimate amount and timing of such liabilities is affected by factors

which are variable and outside our control. In 2010, we are considering making a $250 million

refundable tax deposit relating to potential United States federal tax liabilities arising from our 2003

international restructuring. By making the deposit, interest charges related to the amount of the deposit

will cease. To the extent the deposit is not ultimately used to satisfy federal tax liabilities, it is refundable

62