Western Union 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Arizona and requires us to fund a multi-state not-for-profit organization promoting safety and

security along the United States and Mexico border, in which California, Texas and New Mexico will

participate with Arizona (the “settlement accrual”). The settlement agreement was signed on

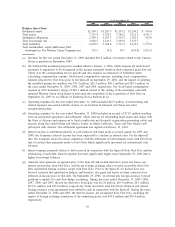

February 11, 2010. Results for 2008 included $82.9 million in restructuring and related expenses.

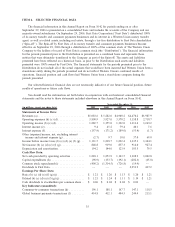

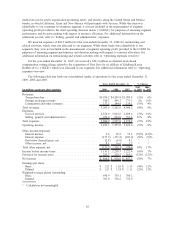

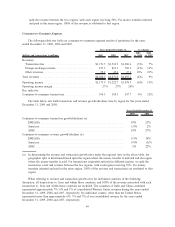

• Our operating income margin was 25% during the year ended December 31, 2009, resulting in a

year-over-year decline of 1%. The current year results included the settlement accrual, while the

prior year results included the restructuring and related expenses mentioned above.

• Consolidated net income during 2009 was $848.8 million, representing a decline of 8% from 2008.

The current results included the settlement accrual of $53.9 million, net of tax, while the prior year

results included $51.6 million in restructuring and related expenses, net of tax.

• Our consumers transferred $71 billion in consumer-to-consumer principal, of which $65 billion

related to cross-border principal, which represented a decrease of 3% in both consumer-to-consumer

principal and cross-border principal over the prior year.

• Consolidated cash flows provided by operating activities were $1,218.1 million, a decrease of 3%

over 2008.

• We completed two acquisitions in the year ended December 31, 2009. In February 2009, we

completed the acquisition of the money transfer business of one of our largest agents, European-

based FEXCO, for $243.6 million, including $157.4 million of cash consideration. As described

earlier, we acquired Custom House in September 2009 for cash consideration of $371.0 million.

Factors that we believe are important to our long-term success include accelerating profitable growth in

our existing consumer-to-consumer business, innovating to provide new products and services, including

electronic channels, to our intended consumer, expanding our global business payments segment to other

markets across the world through our cross-border, cross-currency payment service offerings and improving

our profitability by leveraging our scale, reducing costs and effectively utilizing capital. Significant factors

affecting our financial position and results of operations include:

• Transaction volume is the primary generator of revenue in our businesses. Transaction volume in our

consumer-to-consumer segment is affected by, among other things, the size of the international

migrant population and individual needs to transfer funds in emergency situations. As noted

elsewhere in this Annual Report on Form 10-K, a reduction in the size of the migrant population,

interruptions in migration patterns or reduced employment opportunities including those resulting

from any changes in immigration laws, economic development patterns or political events, could

adversely affect our transaction volume. For discussion on how these factors have impacted us in

recent periods, refer to the consumer-to-consumer segment discussion below.

• Revenue is also impacted by changes in the fees we charge consumers, the principal sent per

transaction and by the variance in the exchange rate set by us to the customer and the rate at which

we or our agents are able to acquire currency. We intend to continue to implement future strategic

fee reductions and actions to reduce foreign exchange spreads, where appropriate, taking into account

growth opportunities and including competitive factors. Decreases in our fees or foreign exchange

spreads generally reduce margins, but are done in anticipation that they will result in increased

transaction volumes and increased revenues over time.

• A majority of our cost structure is comprised of agent commissions, which are generally variable and

fluctuate as revenues fluctuate.

• Fluctuations in the exchange rate between the United States dollar and other currencies impact our

transaction fee and foreign exchange revenue. The impact to earnings per share is less than the

revenue impact due to the translation of expenses and our foreign currency hedging program.

39