Western Union 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

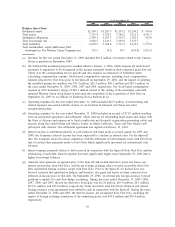

multi-state not-for-profit organization promoting safety and security along the United States and Mexico

border, in which California, Texas and New Mexico will participate with Arizona. While this item was

identifiable to our consumer-to-consumer segment, it was not included in the measurement of segment

operating profit provided to the chief operating decision maker (“CODM”) for purposes of assessing segment

performance and decision making with respect to resource allocation. For additional information on the

settlement accrual, refer to “Selling, general and administrative” expenses.

We incurred expenses of $82.9 million for the year ended December 31, 2008 for restructuring and

related activities, which were not allocated to our segments. While these items were identifiable to our

segments, they were not included in the measurement of segment operating profit provided to the CODM for

purposes of assessing segment performance and decision making with respect to resource allocation. For

additional information on restructuring and related activities refer to “Operating expenses overview.”

For the year ended December 31, 2007, we incurred a $22.3 million accelerated stock-based

compensation vesting charge related to the acquisition of First Data by an affiliate of Kohlberg Kravis

Roberts & Co. (“KKR”) which was allocated to our segments. For additional information refer to “Operating

expenses overview.”

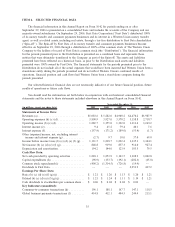

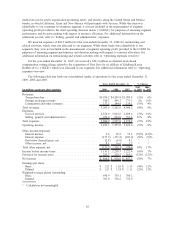

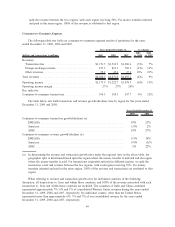

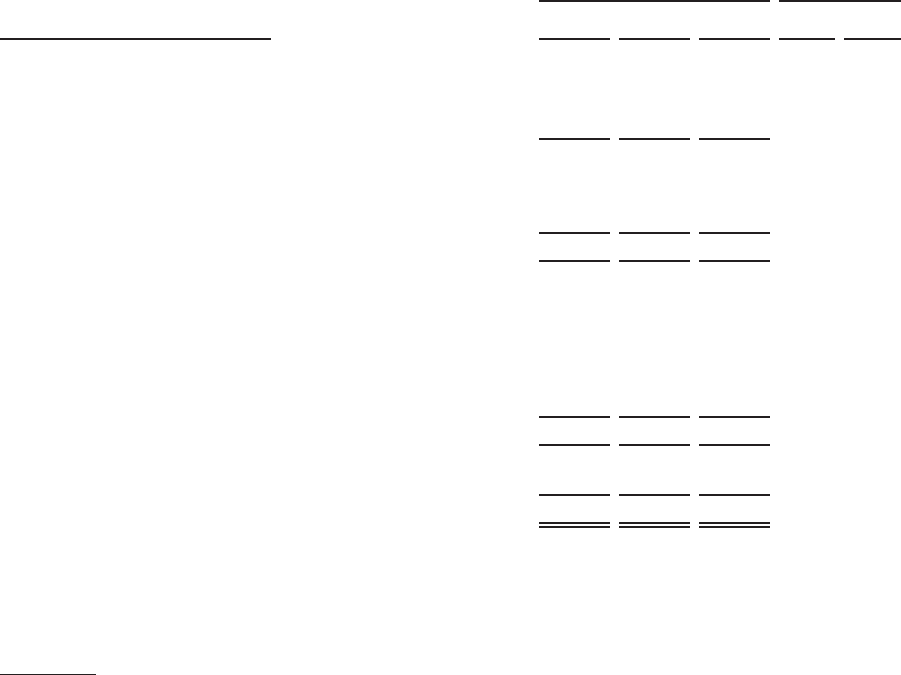

The following table sets forth our consolidated results of operations for the years ended December 31,

2009, 2008 and 2007.

(in millions, except per share amounts) 2009 2008 2007

2009

vs. 2008

2008

vs. 2007

Years Ended December 31, % Change

Revenues:

Transaction fees ................................. $4,036.2 $4,240.8 $3,989.8 (5)% 6%

Foreign exchange revenue .......................... 910.3 896.3 771.3 2% 16%

Commission and other revenues...................... 137.1 144.9 139.1 (5)% 4%

Total revenues .................................... 5,083.6 5,282.0 4,900.2 (4)% 8%

Expenses:

Cost of services ................................. 2,874.9 3,093.0 2,808.4 (7)% 10%

Selling, general and administrative. . . ................. 926.0 834.0 769.8 11% 8%

Total expenses .................................... 3,800.9 3,927.0 3,578.2 (3)% 10%

Operating income .................................. 1,282.7 1,355.0 1,322.0 (5)% 2%

Other income/(expense):

Interest income .................................. 9.4 45.2 79.4 (79)% (43)%

Interest expense ................................. (157.9) (171.2) (189.0) (8)% (9)%

Derivative (losses)/gains, net ........................ (2.8) (6.9) 8.3 * *

Other income, net ................................ 0.1 16.6 1.7 * *

Total other expense, net ............................. (151.2) (116.3) (99.6) 30% 17%

Income before income taxes .......................... 1,131.5 1,238.7 1,222.4 (9)% 1%

Provision for income taxes ........................... 282.7 319.7 365.1 (12)% (12)%

Net income....................................... $ 848.8 $ 919.0 $ 857.3 (8)% 7%

Earnings per share:

Basic ......................................... $ 1.21 $ 1.26 $ 1.13 (4)% 12%

Diluted ........................................ $ 1.21 $ 1.24 $ 1.11 (2)% 12%

Weighted-average shares outstanding:

Basic ......................................... 698.9 730.1 760.2

Diluted ........................................ 701.0 738.2 772.9

* Calculation not meaningful

42