Western Union 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.However, during the fourth quarter of 2008, revenue was impacted by the weakening global economy and

its effect on Western Union customers. In the fourth quarter, transaction growth rates slowed sequentially

compared to the first nine months of 2008. In addition, the amount of money remitted per transaction declined

in the fourth quarter of 2008 compared to the fourth quarter of 2007. These factors resulted in less transaction

fee and foreign exchange revenue in the fourth quarter of 2008 compared to the fourth quarter of 2007.

Fluctuations in the exchange rate between the United States dollar and currencies other than the United

States dollar for the year ended December 31, 2008 resulted in a benefit to transaction fee and foreign

exchange revenue of $96 million, over the previous year, net of foreign currency hedges, that would not have

occurred had there been constant currency rates. The positive impact to operating profit derived from foreign

currency exchange rates increasing against the United States dollar during the year was offset by the impact of

foreign currency derivative losses for those foreign currency derivatives not designated as hedges and the

portion of fair value that is excluded from the measure of effectiveness for these contracts designated as

hedges thereby resulting in a minimal impact to overall earnings per share. The benefit in the first three

quarters of 2008 was slightly offset by the negative impact to consumer-to-consumer transaction fee and

foreign exchange revenue in the fourth quarter of 2008 due to the strengthening of the United States dollar

relative to certain other currencies, including the euro. However, the impact to our operating income was

positive to the fourth quarter of 2008 due to our derivative hedges.

Our Asia Pacific (“APAC”) region also experienced strong transaction and revenue growth during the year

ended December 31, 2008 compared to the corresponding previous period, including growth contributed by the

inbound market to the Philippines. Revenue growth slowed in APAC during the fourth quarter 2008 compared

to the same period in 2007, in part due to the weakening global economy described previously and the decline

in high revenue transactions from small entrepreneurs that typically make purchases in China.

Within our Americas region, our United States to Mexico, United States outbound and transactions in our

domestic (between and within the United States and Canada) businesses continued to be impacted by the

overall weakening in the United States economy. The immigration debate and market softness, in part due to

the slowdown in the construction industry, began adversely impacting the United States businesses in the

second quarter of 2006. We responded to these factors by launching distribution, pricing, advertising,

promotion and community outreach initiatives in 2006 and 2007. Although the United States businesses

revenue decline experienced in 2008 moderated compared with 2007, we experienced increased revenue

declines in the fourth quarter of 2008 compared to the third quarter of 2008, due to the weakening in the

United States economy.

Foreign exchange revenue increased for the year ended December 31, 2008 over the corresponding

previous period, due to an increase in cross-currency transactions primarily as a result of growth in

international consumer-to-consumer transactions. As described above, foreign exchange revenue also benefited

during the year ended December 31, 2008 compared to 2007 from the strengthening of other currencies most

notably the euro, against the United States dollar.

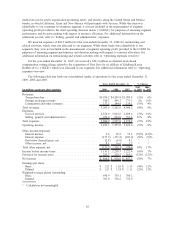

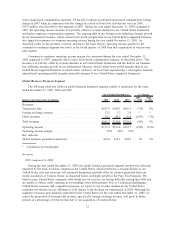

Operating expenses overview

The following factors impacted both cost of services and selling, general and administrative expenses

during the periods presented:

•Restructuring and Related Activities—For the year ended December 31, 2008, restructuring and

related expenses of $62.8 million and $20.1 million are classified within “cost of services” and

“selling, general and administrative” expenses, respectively, in the consolidated statements of income.

These restructuring and related expenses are associated with the closure of our facilities in Missouri

and Texas and other reorganization plans executed in 2008. No expenses were recognized for these

restructurings in 2009.

•2007 Stock Compensation Charge—At the time of the Spin-off, First Data converted stock options,

restricted stock awards, and restricted stock units (collectively, “stock-based awards”) of First Data

stock held by Western Union and First Data employees. Both Western Union and First Data

44