Western Union 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Western Union Company 2006 Non-Employee Director Equity Compensation Plan

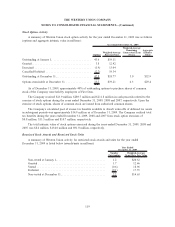

The Western Union Company 2006 Non-Employee Director Equity Compensation Plan (“2006 Director

Plan”) provides for the granting of equity-based awards to non-employee directors of the Company. Options

granted under the 2006 Director Plan are issued with exercise prices equal to the fair value of Western Union

common stock at the grant date, have 10-year terms, and vest immediately. Since options and deferred stock

units under this plan vest immediately, compensation expense is recognized on the date of grant based on the

fair value of the awards when granted. Awards under the plan may be settled immediately unless the

participant elects to defer the receipt of the common shares under applicable plan rules. A maximum of

1.5 million shares of common stock may be awarded under the 2006 Director Plan. As of December 31, 2009,

the Company has issued 0.5 million options and 0.2 million unrestricted stock units to non-employee directors

of the Company.

Impact of Spin-Off to Stock—Based Awards Granted Under First Data Plans

At the time of the Spin-off, First Data converted stock options, restricted stock awards and restricted

stock units (collectively, “Stock-Based Awards”) of First Data stock held by Western Union and First Data

employees. For Western Union employees, each outstanding First Data Stock-Based Award was converted to

new Western Union Stock-Based Awards. For First Data employees, each outstanding First Data Stock-Based

Award held prior to the Spin-off was converted into one replacement First Data Stock-Based Award and one

Western Union Stock-Based Award. The new Western Union and First Data Stock-Based Awards maintained

their pre-conversion aggregate intrinsic values, and, in the case of stock options, their ratio of the exercise

price per share to their fair value per share.

All converted Stock-Based Awards, which had not vested prior to September 24, 2007, were subject to

the terms and conditions applicable to the original First Data Stock-Based Awards, including change of control

provisions which required full vesting upon a change of control of First Data. Accordingly, upon the

completion of the acquisition of First Data on September 24, 2007 by an affiliate of Kohlberg Kravis

Roberts & Co.’s (“KKR”), all of these remaining converted unvested Western Union Stock-Based Awards

vested. In connection with this accelerated vesting, the Company incurred a non-cash pre-tax charge of

$22.3 million during the year ended December 31, 2007 for such awards held by Western Union employees.

Approximately one-third of this charge was recorded within “Cost of services” and two-thirds was recorded

within “Selling, general and administrative expense” in the Consolidated Statements of Income. As a result of

this accelerated vesting, there is no remaining unamortized compensation expense associated with such

converted Stock-Based Awards.

After the Spin-off, the Company receives all cash proceeds related to the exercise of all Western Union

stock options, and recognizes all stock compensation expense and retains the resulting tax benefits relating to

Western Union awards held by Western Union employees. First Data recognizes all stock-based compensation

expense and retains all associated tax benefits for Western Union Stock-Based Awards held by First Data

employees.

118

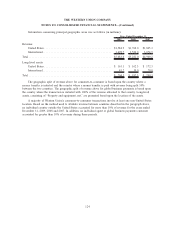

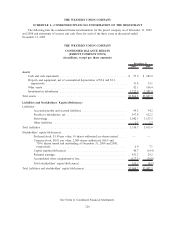

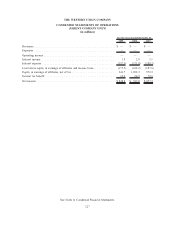

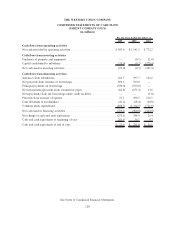

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)