TripAdvisor 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

During 2011, the Singapore Economic Development Board accepted our application to receive a tax incentive under the

International Headquarters Award. This incentive provides for a reduced tax rate on qualifying income of 5% as compared to

Singapore’s statutory tax rate of 17% and is conditional upon our meeting certain employment and investment thresholds. This

agreement is set to expire on June 30, 2016, with the ability to extend for another five years. This benefit resulted in a decrease to the

2014 tax provision of $6 million or an incremental $0.04 to Diluted EPS for 2014.

By virtue of previously filed consolidated income tax returns filed with Expedia, we are currently under an IRS audit for the

2009 and 2010 tax years, and have various ongoing state income tax audits. We are separately under audit for the 2012 tax year. As of

December 31, 2014, no material assessments have resulted from these audits. These audits include questioning of the timing and the

amount of income and deductions and the allocation of income among various tax jurisdictions. Annual tax provisions include

amounts considered sufficient to pay assessments that may result from the examination of prior year returns. We are no longer subject

to tax examinations by tax authorities for years prior to 2007.

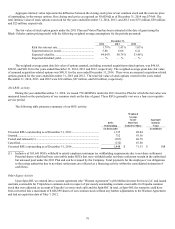

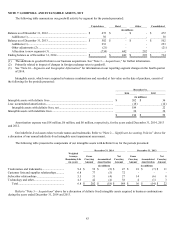

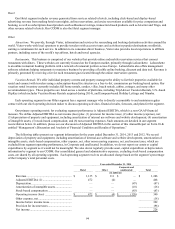

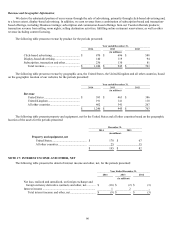

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits (excluding interest and penalties) is as

follows:

December 31,

2014 2013 2012

(in millions)

Balance, beginning of year .............................................................. $36 $24

$ 13

Increases to tax positions related to the current year ....................... 13 12

12

Increases to tax positions related to the prior year ........................... 18 4

—

Reductions due to lapsed statute of limitations................................ — —

—

Decreases to tax positions related to the prior year ......................... — (4 )

—

Settlements during current year ....................................................... — —

(1)

Balance, end of year ........................................................................ $67 $36

$ 24

As of December 31, 2014, we had $67 million of unrecognized tax benefits, net of interest, which is classified as long-term and

included in other long-term liabilities. Of this amount, approximately $65 million would affect the effective tax rate if recognized,

while $2 million would affect goodwill. We recognize interest and penalties related to unrecognized tax benefits in income tax

expense. As of December 31, 2014 and 2013, total gross interest accrued was $4 million and $2 million, respectively. We estimate that

approximately $1 million will be paid within the next year related to audits.

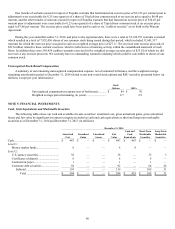

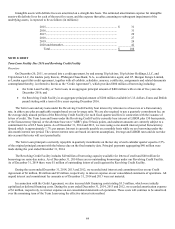

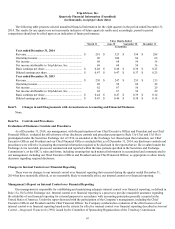

NOTE 10: ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities consisted of the following for the periods presented:

December 31,

2014

December 31,

2013

(in millions)

Accrued salary, bonus, and related benefits .............................. $ 41 $ 35

Accrued marketing costs ........................................................... 24 22

Accrued charitable foundation payments (1) ............................ 9 7

Other ......................................................................................... 40 22

Total accrued expenses and other current liabilities ................. $ 114 $ 86

(1) See “Note 12— Commitments and Contingencies” for information regarding our charitable foundation.