TripAdvisor 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

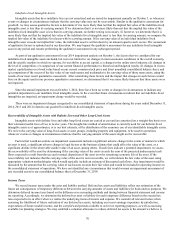

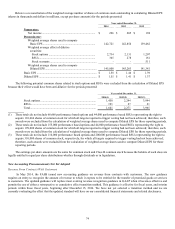

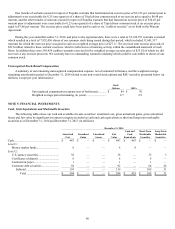

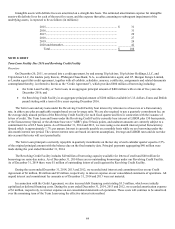

The following table presents the purchase price allocation recorded on our consolidated balance sheet at fair value for all 2013

acquisitions (in millions):

Total

Goodwill (1) .................................................................................................................... $ 30

Intangible assets (2) ......................................................................................................... 19

N

et liabilities assumed (3) ............................................................................................... (10)

Deferred tax assets ........................................................................................................... 1

Total purchase price consideration (4) ....................................................................... $ 40

(1) Goodwill in the amount of $14 million is expected to be deductible for tax purposes.

(2) Identifiable definite-lived intangible assets acquired during 2013 were comprised of trade names of $8 million, subscriber

relationships of $8 million, and developed technology and other of $3 million. The overall weighted-average life of the

identifiable definite-lived intangible assets acquired in the purchase of the companies during 2013 was 8.0 years, which is being

amortized on a straight-line basis over their estimated useful lives from acquisition date.

(3) Includes assets acquired, including cash of $3 million and accounts receivable of $2 million and liabilities assumed, including

accounts payables of $11 million, accrued expenses and other current liabilities of $1 million and deferred revenue of $3 million

which reflected their respective fair values at acquisition date.

(4) Subject to adjustment based on (i) indemnification obligations for general representations and warranties of the acquired

company stockholders.

2012 Acquisitions

We purchased a travel media company for approximately $3 million. The purchase price consideration was primarily allocated

to goodwill, which is not tax deductible. The purchase price and purchase price allocation is final for this acquisition at December 31,

2014.

We also paid $22 million for the remaining noncontrolling interest subsidiary shares related to a 2008 acquisition, which

brought our ownership to 100%. This amount is included in financing activities in our consolidated statement of cash flows for the

year ended December 31, 2012.

NOTE 4: STOCK BASED AWARDS AND OTHER EQUITY INSTRUMENTS

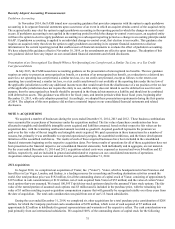

Stock-based Compensation Expense

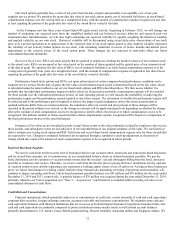

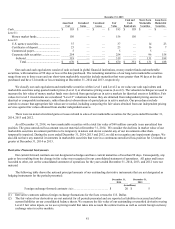

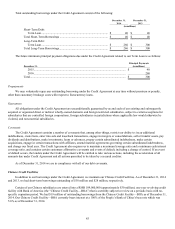

The following table presents the amount of stock-based compensation related to stock-based awards, primarily stock options and

RSUs, on our consolidated statements of operations during the periods presented:

Year ended December 31,

2014 2013 2012

(in millions)

Selling and marketing ............................................................. $ 13 $ 11 $ 5

Technology and content .......................................................... 27 21 11

General and administrative ..................................................... 23 17 14

Total stock-based compensation ....................................... 63 49 30

Income tax benefit from stock-based compensation ............... (24) (18 ) (10)

Total stock-based compensation, net of tax effect .................. $39 $ 31 $ 20

During the years ended December 31, 2014 and 2013, we capitalized $8 million and $5 million, respectively, of stock-based

compensation as website development costs. This amount was immaterial for the year ended December 31, 2012.

Stock and Incentive Plan

On December 20, 2011, our 2011 Stock and Annual Incentive Plan became effective and we filed Post-Effective Amendment

No. 1 on Form S-8 to Registration Statement on Form S-4 (File No. 333-178637) (the “Prior Registration Statement”) with the

Securities and Exchange Commission (the “Commission”), registering a total of 17,500,000 shares of our common stock, of which

17,400,000 shares were issuable in connection with grants of equity-based awards under our 2011 Incentive Plan (7,400,000 of which

shares were originally registered on the Form S-4 and 10,000,000 of which shares were first registered on the Prior Registration