TripAdvisor 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

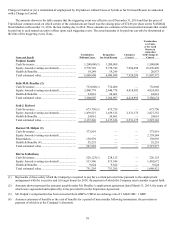

with the Funds’ Boards of Trustees. Fidelity carries out the voting of the shares under written guidelines established by the

Funds’ Boards of Trustees.

(5) Based solely on information contained in a Schedule 13G/A filed with the SEC on February 10, 2015 by The Vanguard Group

(“Vanguard”). According to the Schedule 13G/A, Vanguard beneficially owns 8,233,726 shares but only has sole voting power

with respect to 192,063 shares and sole dispositive power with respect to 8,049,953 shares.

(6) Based solely on information contained in a Schedule 13G filed with the SEC on February 13, 2015 by Prudential Financial, Inc.

(“Prudential”). According to the Schedule 13G, Prudential (through its subsidiaries Jennison Associates, LLC and Quantitative

Management Associates, LLC) beneficially owns 7,466,042 shares, has shared dispositive power with respect to 6,907,248

shares, has sole dispositive power with respect to 558,794 shares, has shared voting power with respect to 4,033,353 shares and

has sole voting power with respect 558,794 shares.

(7) Includes 1,938 shares of common stock that are held by the Maffei Foundation.

(8) Includes options to purchase 622,835 shares of common stock that are currently exercisable or will be exercisable within 60

days of April 20, 2015.

(9) Includes options to purchase 124,947 shares of common stock that are currently exercisable or will be exercisable within 60

days of April 20, 2015.

(10) Includes options to purchase 96,594 shares of common stock that are currently exercisable or will be exercisable within 60 days

of April 20, 2015.

(11) Includes options to purchase 60,327 shares of common stock that that are currently exercisable or will be exercisable within 60

days of April 20, 2015.

(12) Includes options to purchase 21,721 shares of common stock that that are currently exercisable or will be exercisable within 60

days of April 20, 2015.

(13) Includes options to purchase 926,118 shares of common stock that that are currently exercisable or will be exercisable within 60

days of April 20, 2015.

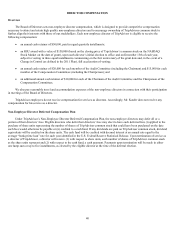

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Exchange Act, TripAdvisor officers and directors and persons who beneficially own more than

10% of a registered class of TripAdvisor’s equity securities are required to file initial statements of beneficial ownership (Form 3) and

statements of changes in beneficial ownership (Forms 4 and 5) with the SEC. Such persons are required by the rules of the SEC to

furnish TripAdvisor with copies of all such forms they file. Based solely on a review of the copies of such forms furnished to

TripAdvisor and/or written representations that no additional forms were required, TripAdvisor believes that all of its directors and

officers complied with all the reporting requirements applicable to them with respect to transactions during 2014.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Review and Approval or Ratification of Related Person Transactions

In general, we will enter into or ratify a “related person transaction” only when it has been approved by the Audit Committee of

the Board of Directors, in accordance with its written charter. Related persons include our executive officers, directors, 5% or more

beneficial owners of our common stock, immediate family members of these persons and entities in which one of these persons has a

direct or indirect material interest. Related person transactions are transactions that meet the minimum threshold for disclosure in the

proxy statement under the relevant SEC rules (generally, transactions involving amounts exceeding $120,000 in which a related

person or entity has a direct or indirect material interest). When a potential related person transaction is identified, management

presents it to the Audit Committee to determine whether to approve or ratify. When determining whether to approve, ratify,

disapprove or reject any related person transaction, the Audit Committee considers all relevant factors, including the extent of the

related person’s interest in the transaction, whether the terms are commercially reasonable and whether the related person transaction

is consistent with the best interests of TripAdvisor and our stockholders.

The legal and accounting departments work with business units throughout TripAdvisor to identify potential related person

transactions prior to execution. In addition, we take the following steps with regard to related person transactions:

x On an annual basis, each director, director nominee and executive officer of TripAdvisor completes a Director and Officer

Questionnaire that requires disclosure of any transaction, arrangement or relationship with us during the last fiscal year in