TripAdvisor 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

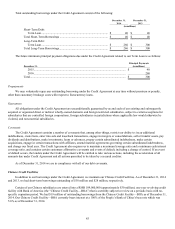

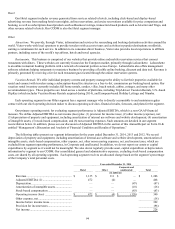

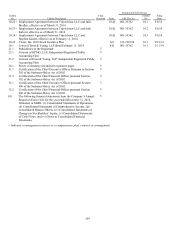

95

Year ended December 31, 2013

Hotel Other Corporate and

unallocated Total

(in millions)

Revenue ............................................................. $899 $ 46 $ — $ 945

Adjusted EBITDA (1) ....................................... 384 (5) — 379

Depreciation ...................................................... — — (30 ) (30)

Amortization of intangible assets ...................... — — (6 ) (6)

Stock-based compensation ................................ — — (49 ) (49)

Operating income (loss) .................................... $384 $ (5) $ (85 ) 294

Other expense, net ............................................. (10)

Income before income taxes .............................. 284

Provision for income taxes ................................ (79)

N

et income ........................................................ 205

Year ended December 31, 2012

Hotel Other Corporate and

unallocated Total

(in millions)

Revenue ............................................................. $732 $ 31 $ — $ 763

Adjusted EBITDA (1) ....................................... 349 3 — 352

Depreciation ...................................................... — — (20 ) (20)

Amortization of intangible assets ...................... — — (6 ) (6)

Stock-based compensation ................................ — — (30 ) (30)

Operating income (loss) .................................... $349 $ 3 $ (56 ) 296

Other expense, net ............................................. (14)

Income before income taxes .............................. 282

Provision for income taxes ................................ (87)

N

et income ........................................................ 195

(1) Includes allocated general and administrative expenses in our Hotel segment of $87 million, $72 million and $56 million; and in

our Other segment of $18 million, $9 million and $6 million for the years ended December 31, 2014, 2013 and 2012,

respectively.

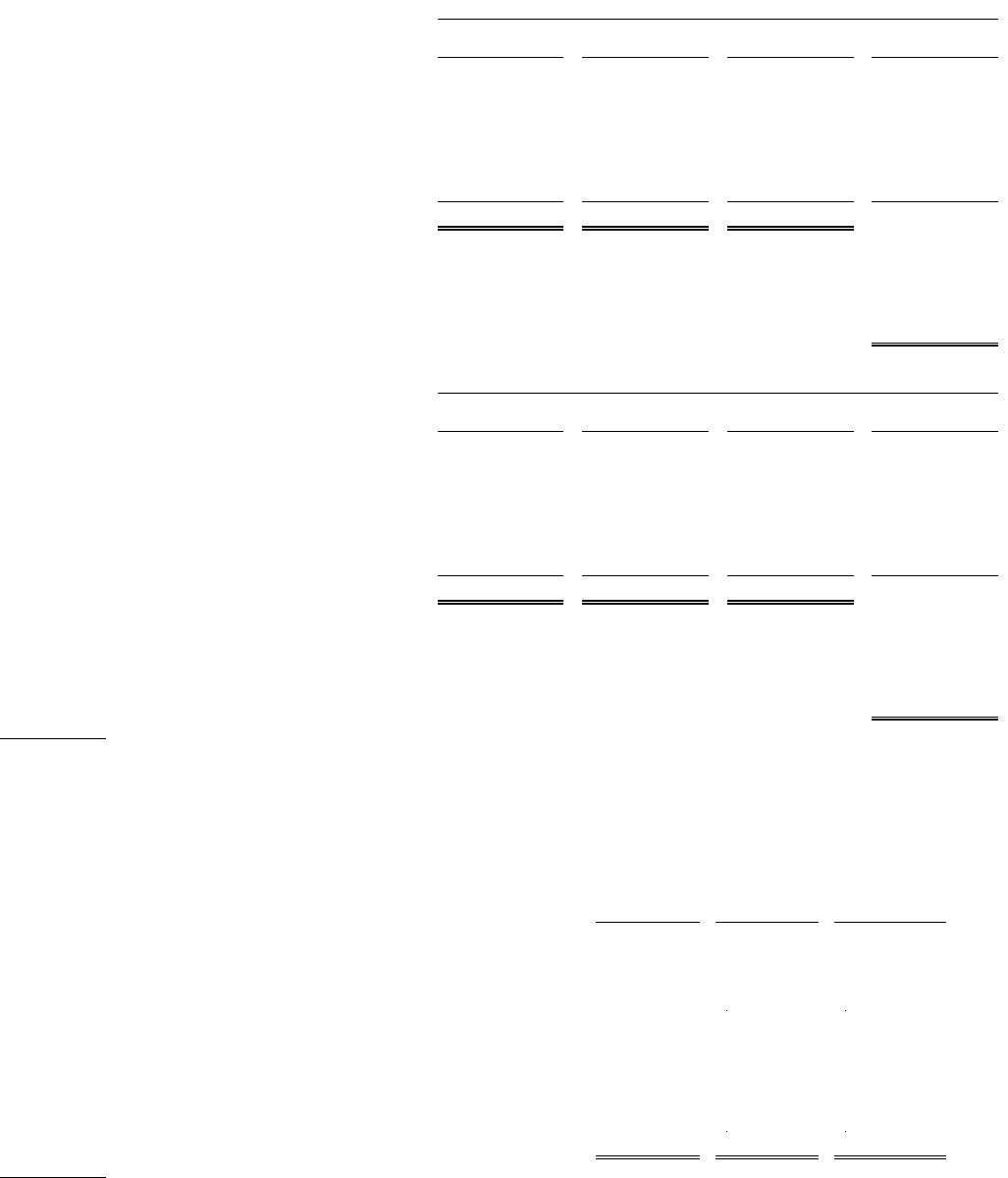

The following table is a reconciliation of our Adjusted EBITDA to net income, the most directly comparable financial measure

calculated and presented in accordance with GAAP, for the periods presented:

Year ended December 31,

2014 2013 2012

(in millions)

Adjusted EBITDA ................................................................ $ 468 $ 379 $ 352

Depreciation (1) ...................................................................... (47) (30 ) (20)

OIBA (2) ................................................................................. 421 349 332

Amortization of intangible assets ........................................... (18) (6 ) (6)

Stock-based compensation ..................................................... (63) (49 ) (30)

Other expense, net .................................................................. (18) (10 ) (14)

Provision for income taxes ..................................................... (96) (79 ) (87)

Net income ............................................................................. $ 226 $ 205 $ 195

(1) Includes amortization of internal use software and website development costs.

(2) We define OIBA as net income (loss) plus: (1) provision for income taxes; (2) other income (expense), net; (3) stock-based compensation;

(4) amortization of intangible assets; and (5) non-recurring expenses. This operating metric is only used by our management to calculate our

annual obligation for our charitable foundation. Refer to “Note 12— Commitments and Contingencies” for a discussion of our charitable

foundation.