TripAdvisor 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Role of Stockholders

TripAdvisor provides its stockholders with the opportunity to cast an advisory vote to approve the compensation of our named

executive officers every three years. In evaluating our 2014 executive compensation program, the Compensation Committees

considered the result of the stockholder advisory vote on our executive compensation (the “say-on-pay vote”) held at our Annual

Meeting of Stockholders on June 26, 2012, which was approved by over 99% of the votes cast. As a result, the Compensation

Committees did not make any significant changes to our executive compensation program for 2014. The Compensation Committees

will continue to consider the outcome of the say-on-pay vote when making future compensation decisions for our named executive

officers.

We will hold a say-on-pay vote every three years until the next vote on the frequency of such stockholder advisory votes, which

will occur no later than our 2018 Annual Meeting of Stockholders. We will hold a say-on-pay vote at this Annual Meeting. Our next

say-on-pay vote, following this meeting, will be held at the annual meeting of our stockholders in 2018.

Compensation Program Elements

General

The primary elements of our executive compensation program are base salary, an annual cash bonus and equity awards.

Generally, the Compensation Committees review these elements in the first quarter of each year in light of our business and individual

performance, recommendations from management and other relevant information, including prior compensation history and

outstanding long-term incentive compensation arrangements. Management and the Compensation Committees believe that there are

multiple, dynamic factors that contribute to success at an individual and business level. Management and the Compensation

Committees have therefore refrained from adopting strict formulas and have relied primarily on a discretionary approach that allows

the Compensation Committees to set executive compensation levels on a case-by-case basis, taking into account all relevant factors.

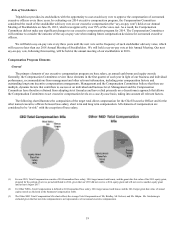

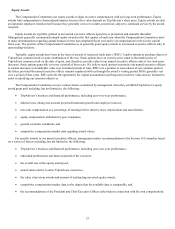

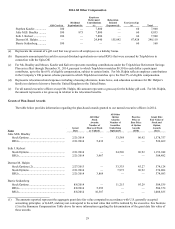

The following chart illustrates the composition of the target total direct compensation for the Chief Executive Officer and for the

other named executive officers between base salary, short term and long term compensation. All elements of compensation are

considered to be “at-risk” with the exception of base salary.

(1) For our CEO, Total Compensation consists of 2014 annualized base salary, 2014 target annual cash bonus, and the grant date fair-value of his 2013 equity grant,

prorated for the portion of service period attributed to 2014, given that our CEO did not receive a 2014 equity grant and will not receive another equity grant

until at least August 2017.

(2) For Other NEOs, Total Compensation is defined as 2014 annualized base salary, 2014 target annual cash bonus, and the 2014 target grant date value of annual

equity awards as disclosed in the Summary Compensation Table.

(3) The Other NEO Total Compensation Mix chart reflects the average Total Compensation of Ms. Bradley, Mr. Kalvert, and Mr. Halpin. Ms. Seidenberg is

excluded given that her new-hire compensation is not representative of our annual executive compensation.