TripAdvisor 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

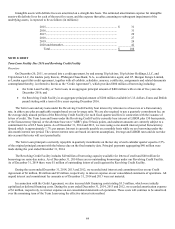

One tranche of warrants (issued in respect of Expedia warrants that had featured an exercise price of $12.23 per warrant prior to

adjustment) were exercisable for 0.25 (one-quarter) of a share of TripAdvisor common stock at an exercise price equal to $6.48 per

warrant, and the other tranche of warrants (issued in respect of Expedia warrants that had featured an exercise price of $14.45 per

warrant prior to adjustment) were exercisable for 0.25 (one-quarter) of a share of TripAdvisor common stock at an exercise price

equal to $7.66 per warrant. The exercise price could have been paid in cash or via “cashless exercise” as set forth in the Warrant

Agreement.

During the year ended December 31, 2012, and prior to the expiration date, there were a total of 32,186,791 warrants exercised

which resulted in a total of 7,952,456 shares of our common stock being issued during that period, which included 31,641,337

warrants for which the exercise price was paid in cash at a weighted average price of $27.11. We received total exercise proceeds of

$215 million related to these warrant exercises, which is reflected as a financing activity within the consolidated statement of cash

flows. In addition there were 545,454 cashless warrants exercised with a weighted average exercise price of $25.92 of which we did

not receive any exercise proceeds. We currently have no outstanding warrants remaining which could be convertible to shares of our

common stock.

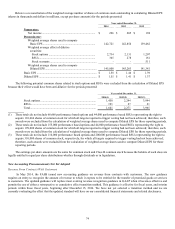

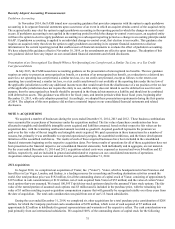

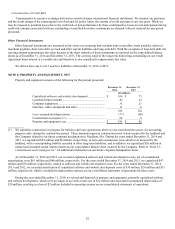

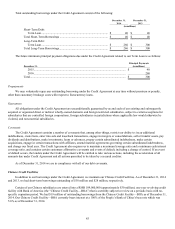

Unrecognized Stock-Based Compensation

A summary of our remaining unrecognized compensation expense, net of estimated forfeitures, and the weighted average

remaining amortization period at December 31, 2014 related to our non-vested stock options and RSU awards is presented below (in

millions, except per year information):

Stock

Options RSUs

Unrecognized compensation expense (net of forfeitures) ........... $ 84 $ 70

Weighted average period remaining (in years) ........................... 2.7 2.9

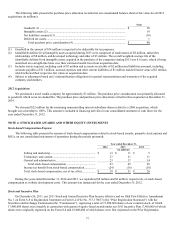

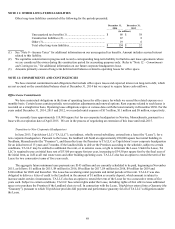

NOTE 5: FINANCIAL INSTRUMENTS

Cash, Cash Equivalents and Marketable Securities

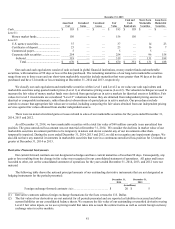

The following tables show our cash and available-for-sale securities’ amortized cost, gross unrealized gains, gross unrealized

losses and fair value by significant investment category recorded as cash and cash equivalents or short and long-term marketable

securities as of December 31, 2014 and December 31, 2013 (in millions):

December 31, 2014

Cash and Short-Term Long-Term

Amortized Unrealized Unrealized Fair Cash Marketable Marketable

Cost Gains Losses Value Equivalents Securities Securities

Cash ............................................................. $ 447 $ — $ — $ 447 $ 447 $ — $ —

Level 1:

Money market funds .............................. 8 — — 8 8 — —

Level 2:

U.S. agency securities ............................ 38 — — 38 — 35 3

Certificates of deposit ............................ 8 — — 8 — 8 —

Commercial paper .................................. 1 — — 1 — 1 —

Corporate debt securities ....................... 92 — — 92 — 64 28

Subtotal ............................................ 139 — — 139 — 108 31

Total ............................................. $ 594 $ — $ — $ 594 $ 455 $ 108 $ 31