TripAdvisor 2014 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2014 TripAdvisor annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

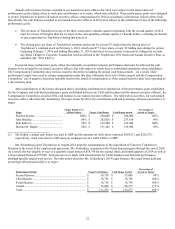

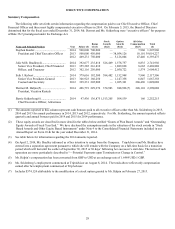

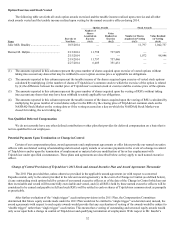

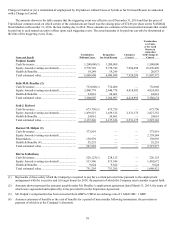

Option Exercises and Stock Vested

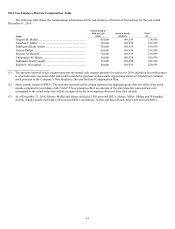

The following table sets forth all stock option awards exercised and the taxable income realized upon exercise and all other

stock awards vested and the taxable income realized upon vesting by the named executive officers during 2014.

Option Awards Stock Awards

Name

Exercise or

Vest Date

Number of

Shares

Acquired on

Exercise

(#)(1)

Value

Realized on

Exercise

($)(2)

Number of Shares

Acquired on Vesting

(#)(3)

Value Realized

on Vesting

($)(4)

Julie M.B. Bradley ....................................... 10/3/2014 — — 11,797 1,042,737

Dermot M. Halpin ........................................ 2/13/2014 11,798 727,829 — —

2/15/2014 — — 1,072 98,946

2/19/2014 11,797 757,446 — —

2/27/2014 6,405 351,451 — —

(1) The amounts reported in this column represent the gross number of shares acquired upon exercise of vested options without

taking into account any shares that may be withheld to cover option exercise price or applicable tax obligations.

(2) The amounts reported in this column represent the taxable income of the shares acquired upon exercise of vested stock options

calculated by multiplying (i) the number of shares of TripAdvisor’s common stock to which the exercise of the option is related

by (ii) the difference between the market price of TripAdvisor’s common stock at exercise and the exercise price of the options.

(3) The amounts reported in this column represent the gross number of shares acquired upon the vesting of RSUs without taking

into account any shares that may have been withheld to satisfy applicable tax obligations.

(4) The amounts reported in this column represent the taxable income of the shares acquired upon the vesting of RSUs calculated by

multiplying the gross number of vested shares subject to the RSUs by the closing price of TripAdvisor common stock on the

NASDAQ Stock Market on the vesting date or if the vesting occurred on a day on which the NASDAQ Stock Market was

closed for trading, the next trading day.

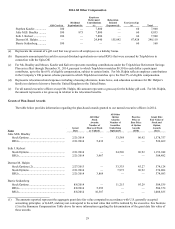

Non-Qualified Deferred Compensation

We do not currently have any other defined contribution or other plan that provides for deferred compensation on a basis that is

not tax-qualified for our employees.

Potential Payments Upon Termination or Change in Control

Certain of our compensation plans, award agreements and employment agreements or offer letters provide our named executive

officers with accelerated vesting of outstanding and unvested equity awards or severance payments in the event of a change in control

of TripAdvisor and/or upon the termination of employment or material adverse modification of his or her employment with

TripAdvisor under specified circumstances. These plans and agreements are described below as they apply to each named executive

officer.

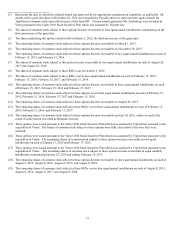

Change of Control Provisions of TripAdvisor’s 2011 Stock and Annual Incentive Plan and Award Agreements Thereunder

The 2011 Plan provided that, unless otherwise provided in the applicable award agreement (or with respect to converted

Expedia awards, only to the extent provided in the relevant award agreement), in the event of a Change in Control (as defined below),

(i) any outstanding stock options held by certain of our named executive officers as of the date of the Change in Control which are not

then exercisable and vested will become fully exercisable and vested, and (ii) all RSUs held by these named executive officers will be

considered to be earned and payable in full and such RSUs will be settled in cash or shares of TripAdvisor common stock as promptly

as practicable.

After further evaluation of the “single trigger” acceleration provisions in the 2011 Plan, the Compensation Committees

determined that future equity awards made under the 2011 Plan would not be entitled to “single trigger” acceleration and, instead, the

award agreements with respect to such equity awards would provide that any acceleration of vesting of the awards would be subject to

“double trigger” rather than “single trigger” acceleration. This means that a vesting of outstanding and unvested equity awards would

only occur upon both a change in control of TripAdvisor and qualifying termination of employment. With respect to Mr. Kaufer’s